Married and freelancing in Spain? What you should know about tax allowances

- How taxes work for married couples in Spain

- What freelancers need to know about declaring income

- Regional tax differences and extra allowances

- The administrative burden of being self-employed in Spain

- Hightekers’ solution: making relocation and tax filing easy for married freelancers

- Relocate as a couple, work with confidence

Spain has become one of Europe’s most popular destinations for freelancers and remote workers. With its enviable climate, affordable living costs compared to other Western European countries, and excellent healthcare system, it’s easy to understand why many professionals choose to relocate here, often bringing their partners or families along.

However, moving abroad is more than a lifestyle decision; it’s also a financial one. If you’re a freelancer relocating to Spain with your spouse or partner, understanding how marital status affects your taxes is crucial. Spain’s tax system is known for being complex, but careful planning can help you maximise allowances and avoid costly mistakes.

Whether you’re working remotely for international clients or building your freelance activity from a sunny terrace, knowing the basics about married couple tax allowance in Spain will ensure you start off on the right foot. And if managing Spanish bureaucracy sounds overwhelming, in this guide, you’ll be glad to know that solutions like Hightekers can simplify the entire process for you.

How taxes work for married couples in Spain

One of the first questions freelancers ask when moving to Spain is whether to file taxes individually or jointly. Spain’s tax system allows for both options — known as declaración individual (individual declaration) and declaración conjunta (joint declaration).

Individual vs. joint tax declarations:

- Individual filing means each spouse or partner declares and pays tax on their own income separately. This is usually more beneficial when both individuals have similar income levels.

- Joint filing combines the income of both partners into a single tax return. It’s available to married couples or those in registered civil partnerships (pareja de hecho).

When is joint filing beneficial?

Joint filing in Spain is typically advantageous when one partner earns significantly less than the other or no income at all. Why? Because the joint declaration applies a fixed deduction of €3,400 to the total taxable income, it potentially lowers your overall tax bill.

For example, if one partner has a freelance income of €35,000 and the other has no income, joint filing could reduce the taxable base enough to move into a lower tax bracket, resulting in real savings.

However, if both partners are high earners, joint filing often results in a higher total tax bill, as it can push the combined income into a higher bracket.

Spain’s tax system also offers family-related deductions, including:

- Dedications for dependent children

- Dedications for mortgage payments on a primary residence

- Maternity and large-family tax credits

- Disability allowances, where applicable

Many of these deductions are available whether you file jointly or individually, but careful planning ensures you take full advantage of them.

What freelancers need to know about declaring income

If you’re self-employed in Spain, the way you declare income is slightly different from that of salaried employees. As a freelancer (autónomo), you’re responsible for reporting your earnings accurately and paying tax on them.

Freelance income is treated as personal income, and it can be included in a joint tax declaration. However, you must first ensure that your freelance income is recorded correctly, including allowable deductions for business expenses, before calculating the final taxable amount.

Joint filing doesn’t alter your obligations as a freelancer: you’ll still need to keep records, submit quarterly tax payments, and account for VAT if required. The joint return simply aggregates your income with your partner’s and applies the relevant deductions and tax rates.

Spanish tax brackets and marital status impact

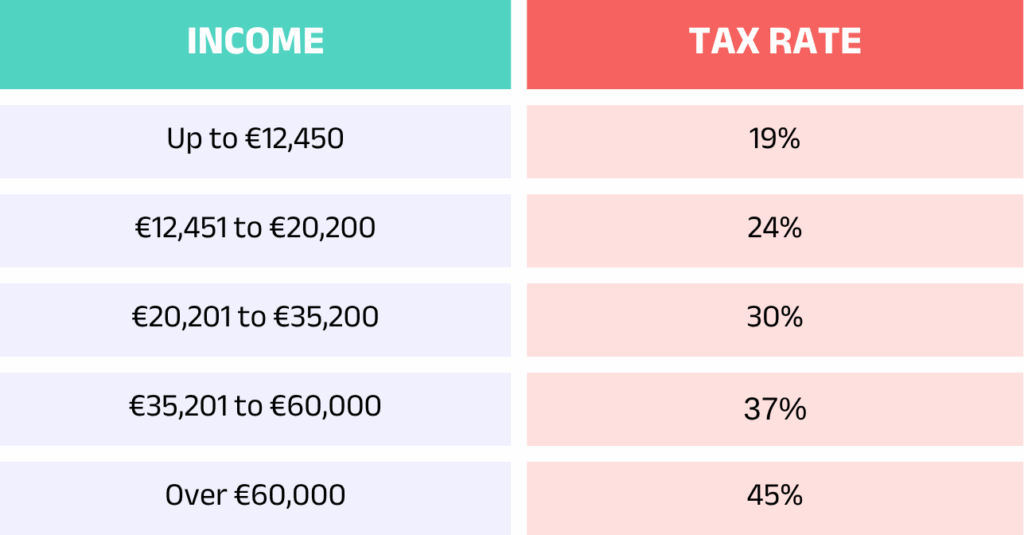

Spain uses a progressive tax system, with income tax rates ranging from 19% to 47%. As your taxable income increases, so does the percentage you pay. Filing jointly can sometimes help reduce the marginal tax rate if it pulls your overall household income into a lower band.

For 2024, the general tax brackets in Spain are:

These rates apply to individual income, but joint declarations adjust the taxable amount by combining earnings and applying family deductions, which can sometimes result in a more favourable tax rate for freelancers with a non-working spouse.

Filing taxes correctly as a freelancer involves:

- Registering as autónomo with the Spanish tax authorities (Agencia Tributaria)

- Submitting quarterly VAT returns if applicable

- Paying quarterly income tax on account

- Completing an annual income tax return (Declaración de la Renta)

When filing jointly, additional paperwork must be submitted to declare the income of both partners, even if one partner has no income. To avoid the risks of tax errors and potential misclassification, it’s always better to work with an experienced bookkeeper (hestor), who can ensure your freelance income is accurately reported and fully compliant with Spanish regulations.

Regional tax differences and extra allowances

Spain’s tax system is unique in that many autonomous communities (regions) apply their own variations to tax rules. This means that your tax bill may differ depending on whether you live in Madrid, Catalonia, Andalusia, or elsewhere.

For example:

- Madrid offers higher deductions for large families and maternity expenses.

- Catalonia applies different thresholds for family and housing deductions.

- Andalusia offers additional tax credits for young families and dependents with disabilities.

Understanding these regional differences is key to optimising your tax situation as a freelancer, married or partnered in Spain. However, accessing this information can be challenging if you’re unfamiliar with the language or local regulations.

The administrative burden of being self-employed in Spain

Becoming self-employed (autónomo) in Spain is certainly possible, but it comes with a significant administrative burden. The process demands careful navigation through a system that, while standardised, can feel complicated and overwhelming, especially for newcomers.

Firstly, you must register with Social Security (Seguridad Social) to contribute towards your pension, healthcare, and other public benefits. This is a mandatory step, and contributions are due monthly, regardless of income level, which can be a surprise to those used to more flexible systems elsewhere.

You’ll also need to obtain a NIE (Número de Identificación de Extranjero), a foreigner’s identification number that is essential for any official transaction in Spain, from opening a bank account to signing a rental contract.

Once these steps are complete, you must register your freelance activity with the Agencia Tributaria (the Spanish tax office).

Here, you declare the nature of your freelance business and register for VAT (IVA) if applicable. Spanish freelancers are responsible for:

- Filing quarterly VAT returns (Modelo 303), reporting the VAT collected and deductible VAT on expenses.

- Paying quarterly personal income tax (Modelo 130) in advance, based on your declared income.

- Submitting annual income tax returns (Declaración de la Renta), where all earnings and deductions must be accurately summarised.

Beyond tax filings, freelancers are required to maintain detailed financial records, including invoices issued and received, VAT ledgers, and receipts for deductible expenses. These records must be kept meticulously, as tax authorities can request them at any time for inspection.

For married freelancers, especially those planning to file a joint tax return, the complexity becomes even greater. Combining two income streams into one tax declaration demands precise coordination, ensuring the correct deductions and allowances are applied without misreporting. Missteps, such as missing quarterly tax deadlines, incorrectly calculating VAT, or errors in joint filing, can result in significant fines and penalties.

Moreover, the language barrier presents an added challenge. Most administrative forms and government communications are in Spanish, and while some resources are available in English, official procedures typically require fluency in legal and financial terminology.

Given these layers of complexity, working with a knowledgeable bookkeeper can be invaluable. A professional can ensure that your filings are accurate, deadlines are met, and your tax situation is optimised, dramatically reducing the risk of errors or misclassification.

For those seeking to avoid these administrative hurdles altogether, solutions like Hightekers offer a more leisurely, compliant alternative, allowing freelancers to focus on their work rather than the paperwork.

Hightekers’ solution: making relocation and tax filing easy for married freelancers

Relocating to Spain as a freelancer with your partner should be exciting, not overwhelming. That’s where Hightekers offers an attractive alternative.

Rather than registering as self-employed and navigating Spain’s complex tax and social security systems on your own, Hightekers acts as your legal employer, offering a fully compliant structure that simplifies the entire process.

How Hightekers helps:

- No need to register as autónomo: You remain independent but legally employed, avoiding the burdens of self-employment registration.

- Client relationships stay intact: Hightekers establishes a service agreement with your existing clients, so nothing changes for them.

- Employment contract with full benefits: You receive a local employment contract through Hightekers, including access to social security, healthcare, and other benefits.

- Tax and payroll managed for you: Hightekers handles all tax filings, monthly payroll, and social security contributions, meaning less paperwork and fewer worries.

- Simplified tax arrangements for married couples: Your income is managed in a way that makes filing a joint tax return straightforward and fully compliant.

For example, when Mark and Emily, a freelance designer and writer from the UK, decided to move to Spain, they were excited about the lifestyle change, but quickly became overwhelmed by the administrative demands. Registering as autónomos, managing quarterly tax returns, and filing joint declarations seemed complicated and time-consuming, especially with the added challenge of Spanish bureaucracy.

That’s when they found Hightekers. By acting as their legal employer in Spain, Hightekers provided them with compliant employment contracts, handled all their tax filings and social security contributions, and maintained their existing client relationships through simple service agreements. Now, Mark and Emily enjoy a stable monthly income, access to Spanish healthcare, and a smooth, fully compliant tax setup: all without the stress of managing it themselves.

With Hightekers, freelancers relocating with a partner can focus on building their careers and enjoying their new lives in Spain, without spending endless hours trying to understand complex tax codes or risking non-compliance.

Relocate as a couple, work with confidence

Relocating to Spain as a freelancer with your spouse or partner is an exciting opportunity, but it demands careful tax planning. Understanding how the married couple tax allowance in Spain works can make a real difference to your financial well-being and peace of mind.

Rather than tackling Spain’s bureaucratic systems alone, freelancers can turn to Hightekers for a simple, compliant, and stress-free solution. By managing your tax filings, social security, and client contracts, we help you focus on what truly matters: building a successful freelance career and enjoying life in one of Europe’s most beautiful countries.

Simplify your relocation to Spain with Hightekers