Spain vs UK: How do freelance taxes compare in 2025?

More freelancers than ever are considering relocating to Spain, drawn by its vibrant culture, lower living costs, and growing digital nomad infrastructure. But alongside the lifestyle upgrade comes an essential financial question: how do freelance taxes in Spain compare to those in the UK?

In 2025, tax systems in both countries will remain quite different, and making the move without a clear understanding of the financial implications could lead to costly mistakes. This guide breaks down the key differences in freelance tax systems between Spain and the UK and introduces a more straightforward way to manage compliance, especially if you’re planning to work across borders.

Freelance income tax: Spain vs UK

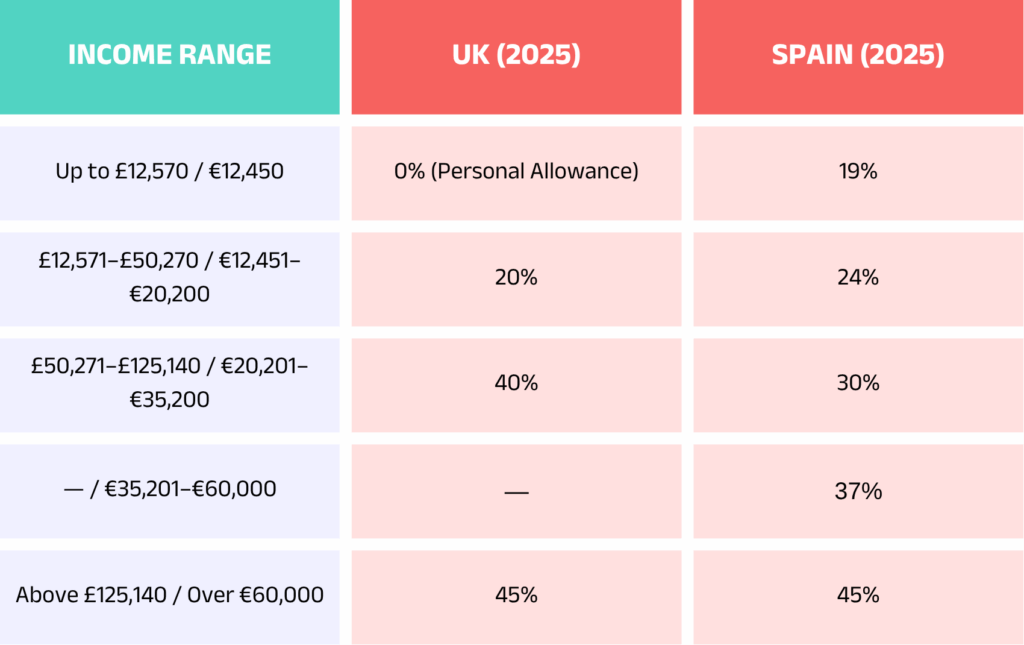

Let’s begin with how each country taxes freelance income. In both Spain and the UK, income tax is progressive, meaning you pay a higher rate as your income increases. But the bands, allowances, and deductions vary.

UK (2025 income tax brackets)

- Up to £12,570: 0% (Personal Allowance)

- £12,571 to £50,270: 20%

- £50,271 to £125,140: 40%

- Above £125,140: 45%

Spain (2025 national income tax brackets)

- Up to €12,450: 19%

- €12,451 to €20,200: 24%

- €20,201 to €35,200: 30%

- €35,201 to €60,000: 37%

- Over €60,000: 45%

Here is a table to compare income tax brackets in both countries:

Spain’s brackets look similar, but there’s a significant difference: in the UK, the first £12,570 is tax-free due to the Personal Allowance. In Spain, even the lowest band is taxed, although there are personal allowances and deductions that lower your taxable base. Additionally, Spanish residents may be subject to regional taxes, depending on their place of residence.

In general, low- to middle-income earners may find UK tax more favourable, while higher earners might find opportunities in Spain through tax incentives, such as the Beckham Law (more on that later).

VAT and business registration

Freelancers in both the UK and Spain must deal with VAT (Value Added Tax), but the systems differ significantly in their thresholds, obligations, and complexity.

In the UK, VAT registration is only required once your taxable turnover exceeds £85,000 in a rolling 12-month period — a relatively high threshold by international standards. Many freelancers, particularly sole traders or those offering services, fall below this level and therefore avoid VAT registration altogether. However, once registered, they must charge VAT on all applicable services, file returns (usually every quarter), and manage both input and output VAT. To ease the administrative burden, some freelancers utilize the Flat Rate Scheme, which streamlines VAT calculations and reporting.

Spain takes a very different approach. Most freelancers (autónomos), regardless of income level, are required to register for VAT (known locally as IVA). This entails issuing compliant invoices with IVA, filing quarterly VAT returns, and utilizing certified accounting tools that meet stringent local requirements. Even if your annual income is relatively modest, you’re still expected to comply with the whole VAT regime.

For freelancers relocating from the UK, this can be one of the most striking differences. The added administrative burden, from invoicing formats to more frequent tax filings, can feel overwhelming at first. It’s essential to understand these obligations in advance and, ideally, work with a local advisor or compliance partner.

Hightekers offers a simplified solution by managing VAT obligations for freelancers within its compliant employment structure, allowing you to stay focused on your work while we handle the paperwork.

Social security contributions

Social contributions are another major difference. In the UK, freelancers pay National Insurance (NI) contributions:

- Class 2 NI: £179.40 annually (2025, if profits over £6,725)

Class 4 NI: 9% on profits between £50,270 and £125,140, and 2% thereafter

In Spain, self-employed professionals (autónomos) pay monthly contributions to the social security system (RETA). These are:

- Based on income

- Starting around €230/month (first year tarifa plana rate for new freelancers)

- Up to €500+/month depending on earnings

While UK NI contributions are relatively light for freelancers, Spain’s monthly fees can significantly impact cash flow. The good news is that Spain offers a flat-rate contribution (tarifa plana) for new autónomos, which reduces costs for the first few years of activity.

Tax reliefs and incentives in Spain

Spain also offers tax incentives to attract skilled professionals. One of the most notable is the Beckham Law (special expatriate tax regime). This allows qualifying expats to pay a flat 24% tax rate on Spanish-source income up to €600,000 for up to 6 years, with no need to declare foreign income. It’s designed to attract high-income earners and is particularly beneficial for freelancers relocating to Spain for the long term.

In contrast, UK freelancers benefit from reliefs like:

- £1,000 trading allowance (no need to register if earning under this)

- Flat-rate expense deductions (simplifies tax filings)

While the UK system offers small, straightforward perks, Spain’s incentives can provide significant savings for eligible freelancers with higher earnings.

Double taxation and tax residency considerations

When freelancing across borders, such as living in Spain while earning from UK clients, understanding double taxation agreements (DTAs) and tax residency rules is essential to staying compliant and avoiding paying tax twice on the same income.

Fortunately, Spain and the UK have a double tax agreement (DTA) in place. This treaty ensures that, in most cases, you won’t be taxed twice on the same income. However, the benefits of the agreement are not automatic. You must prove your tax residency status and submit the appropriate forms to claim relief. For example, UK freelancers living in Spain may need to complete a Modelo 100 income tax return, along with DTA forms, to avoid double taxation on their UK earnings.

Both countries follow the 183-day rule to determine tax residency. If you spend more than 183 days a year in Spain, or your primary home or economic centre is there, you’re considered a Spanish tax resident. This means you’ll be taxed on your worldwide income, not just what you earn from Spanish sources. Similarly, if your family, financial ties, or main business is in Spain, residency may still apply even if you spend fewer than 183 days there.

Failing to establish your tax residency correctly or not declaring income can result in penalties, unexpected tax demands, or difficulties renewing your visa or obtaining legal residence in Spain.

Hightekers helps freelancers avoid these pitfalls by managing international tax compliance and ensuring all income is reported correctly, making cross-border freelancing much simpler and safer.

Hightekers’ solution: compliant freelancing across Spain and the UK

For freelancers working with UK clients while living in Spain (or vice versa), managing taxes, social contributions, and compliance can become a severe burden. That’s where Hightekers steps in.

Hightekers provides a fully compliant structure that enables freelancers to operate across borders without needing to register as self-employed or set up a business abroad.

We act as the legal employer of the freelancer, signing a service agreement with their client and issuing an employment contract to the freelancer. This includes:

- A monthly salary paid on fixed dates

- Full coverage of local social contributions and taxes

- Employee benefits and protections

- Total management of VAT, invoicing, and compliance

Freelancers can live in Spain, work for UK or international clients, and stay fully compliant without dealing with quarterly filings, registration with tax offices, or invoicing systems in a foreign language.

For example, a UK-based freelancer planned to relocate to Madrid. The freelancer wanted to continue working for their UK client while taking advantage of Spain’s Beckham Law, which offers reduced income tax rates for qualified foreign workers.

Hightekers stepped in to provide a compliant solution. We became the freelancer’s legal employer in Spain, established a service agreement with the UK client, and handled all payroll, invoicing, and social contributions.

Our team also ensured the freelancer met all eligibility criteria for the Beckham Law and guided them through the application process. The result? The freelancer received a permanent contract, and could keep their project with the UK client seamlessly. Also, they benefited from a significantly reduced tax rate for up to six years.

For married freelancers or families, Hightekers also simplifies joint filings, social contributions, and eligibility for allowances, especially helpful in Spain’s complex regional tax landscape.

It’s an ideal setup for high-skilled professionals who want freedom and flexibility but don’t want to become tax experts.

Choose your freelance destination, let Hightekers handle the rest

Spain and the UK both offer solid frameworks for freelancers, but they differ significantly in complexity, cost, and incentives. Spain may offer better lifestyle perks and long-term tax breaks like the Beckham Law, but it also demands more administrative work. The UK remains simpler to manage on your own, but may lack incentives for higher earners.

Regardless of the destination you choose, staying compliant is crucial. Hightekers removes the guesswork by providing a legal, stress-free way to freelance internationally. You keep your clients and your freedom, we handle the rest.

Simplify your freelance activity with Hightekers