Living in Barcelona, working with UK clients: a freelancer’s guide

- Can you live in Barcelona and work for a UK company?

- Understanding tax residency and income declarations

- Double taxation and how to avoid it

- Social security and healthcare: what freelancers need to know

- Invoicing from Spain to the UK: key points

- How Hightekers helps freelancers in Spain stay compliant and work with UK clients

- Keep working with UK clients, from your base in Barcelona

Barcelona has become one of Europe’s top hubs for freelancers and digital nomads. With its Mediterranean climate, vibrant culture, and a thriving ecosystem of coworking spaces and international startups, it offers a unique quality of life for remote professionals.

Among those drawn to the city are UK-based freelancers who want to keep working with their clients back home while enjoying everything Barcelona has to offer.

But living in Spain and working for UK clients comes with responsibilities. Understanding how tax, residency, and legal obligations work across borders is key to avoiding fines or issues with either government. This guide breaks it all down and shows how Hightekers can offer a smoother way forward.

Can you live in Barcelona and work for a UK company?

Short answer: yes, but you need to do it legally.

Many freelancers assume that working remotely exempts them from local obligations, but that’s a common and costly mistake. If you live in Spain for more than 183 days in a calendar year, you’re legally considered a Spanish tax resident, regardless of where your clients are located or where the work is delivered.

This has several important implications. First, you’re required to declare your worldwide income to the Spanish tax authorities, including income earned from UK-based clients.

Second, as a tax resident, you may need to register with and contribute to the Spanish social security system.

Third, invoicing UK clients while living in Spain requires the proper legal structure, either through registration as a self-employed worker (autónomo) or by using a compliant alternative such as an Employer of Record.

Failing to comply with these rules can lead to problems down the line. You could face double taxation, incur fines for late or incorrect filings, or even jeopardise your legal residency status. To avoid these issues, it’s vital to establish the correct framework from the outset, ensuring that both your business activities and personal status are fully aligned with Spanish law.

Understanding tax residency and income declarations

Spain uses the 183-day rule to determine whether you’re a tax resident. If you live in the country for more than half the year, even non-consecutively, you’re considered a Spanish tax resident. But even if you spend less time, you may still qualify if Spain is your primary centre of economic or personal interests, such as where your family lives or where you own property.

Once you’re classed as a resident, you must declare your worldwide income to the Spanish tax authorities. This includes income earned from UK clients or any international source. Many freelancers think that if they’re paid from abroad, they can avoid Spanish taxation, but this is not the case.

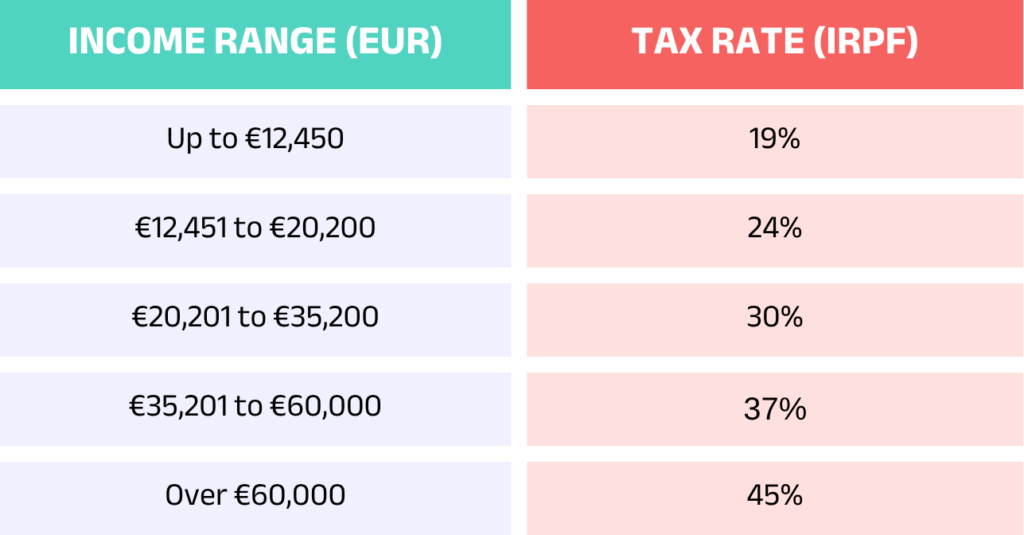

Spain applies progressive income tax rates through the IRPF system. The following table outlines the national tax brackets for 2024:

Spanish income tax (IRPF) brackets in 2024

Note: In Catalonia and other autonomous communities, regional income tax rates may also apply, which can result in a higher overall tax burden depending on your total income.

Double taxation and how to avoid it

The UK and Spain have a double taxation agreement (DTA) designed to prevent freelancers from being taxed twice on the same income. To benefit from this treaty, it’s essential to be appropriately registered with the Spanish tax authorities and to declare any income earned from UK sources.

Freelancers living in Spain must submit the correct forms, such as Model 100, to ensure their income is reported accurately. Under the agreement, Spain, as the country of residence, typically holds the primary taxing rights, while the UK may offer exemptions or tax credits.

However, this system only works smoothly when all legal and administrative requirements are met. Delayed filings or incorrect declarations can trigger penalties, additional scrutiny, or even complications with your residency or visa status.

To avoid issues, freelancers should ensure their cross-border income is fully compliant with both Spanish and UK tax laws and that all paperwork is filed correctly and on time.

Social security and healthcare: what freelancers need to know

Once you become a Spanish tax resident and start earning income, you’re generally expected to register with and contribute to the Spanish social security system, even if your income comes from UK clients or international sources.

This contribution typically includes:

- Monthly payments to access Spain’s public healthcare system

- Contributions towards pension, disability, and unemployment coverage

- Registration as “autónomo” (self-employed), unless you use an alternative legal structure (such as through an Employer of Record)

For most freelancers, registering as autónomo is the standard path. However, this comes with administrative responsibilities, such as quarterly tax filings and VAT returns, and a fixed monthly social security fee that applies even if your income is low or irregular.

Some freelancers, especially those newly arrived or working with overseas clients, may be tempted to delay or avoid registration. Although working “under the radar” is risky. If you fail to register correctly and the authorities find out, for example, during a routine audit or healthcare access request, you could face fines, backdated payments, and denied access to public services, including healthcare.

Freelancers who want to live and work in Spain legally and sustainably must set up the proper structure from the beginning. This ensures not only legal compliance but also peace of mind when it comes to accessing healthcare, building pension rights, and avoiding unpleasant surprises down the line. If autónomo status feels overwhelming, solutions like Hightekers can offer a fully compliant alternative.

Invoicing from Spain to the UK: key points

Freelancers living in Barcelona and invoicing UK clients must comply with Spanish and EU invoicing rules.

Each invoice should include:

- Your Spanish tax ID (NIF)

- Your name and address in Spain

- The UK client’s full details

- Description of the service

- Invoice number and date

- Total amount and VAT treatment (if applicable)

VAT note: If your UK client is a business with a valid VAT number, you can issue the invoice without charging Spanish VAT under the reverse charge mechanism. However, you must still register for VAT (IVA) in Spain and file quarterly returns.

Currency, payment method, and client expectations should all be documented to avoid miscommunication.

How Hightekers helps freelancers in Spain stay compliant and work with UK clients

Setting up as a freelancer in Spain can feel overwhelming. Between registering as autónomo, navigating VAT, and filing local and international tax documents, it’s easy to lose focus on your actual work. That’s where Hightekers comes in.

We offer a fully compliant alternative to freelancing on your own. Our model allows you to live in Barcelona and work with UK clients legally and efficiently, without having to register as self-employed in Spain.

Here’s how it works:

- Hightekers becomes your legal employer

- We sign a service agreement with your UK client on your behalf

- You receive a permanent employment contract, with a fixed monthly salary

- We handle your taxes, social security payments, and international invoicing

- You get access to employee benefits and social security coverage in Spain

For example, Emma, a UK-based graphic designer, moved to Barcelona to enjoy a better lifestyle while keeping her UK clients. Instead of registering as self-employed in Spain, she partnered with Hightekers. They acted as her legal employer, set up a service agreement with her UK client, and provided her with a permanent contract. Now, Emma receives a stable monthly income, stays fully compliant with Spanish tax and social security rules, and focuses entirely on her creative work, without worrying about admin or legal risks.

This ensures full compliance in both Spain and the UK, keeps your client relationships intact, and relieves you from complex admin or risky misfiling.

Keep working with UK clients, from your base in Barcelona

Relocating to Spain doesn’t mean giving up your UK freelance career. With the right structure, you can live in Barcelona, work for UK clients, and stay legally compliant with both tax and social security obligations.

Hightekers makes this possible with a simple, secure solution tailored to international freelancers. If you want to focus on your work instead of Spanish bureaucracy, we’re here to help.

Simplify your relocation to Barcelona with Hightekers