Freelancer tax UK: What You Must Know

For the nearly 4.2 million self-employed people in the UK, mastering the tax system is a non-negotiable part of the business. As a freelancer, you are the captain of your ship, and that means you are also its chief financial officer.

This freelance UK tax guide is designed to give you the confidence to navigate your tax obligations with clarity and ease. Forget the anxiety of unknown forms and looming deadlines. We are breaking down everything you need to know about your freelancer tax rules when expanding to the UK.

What taxes do freelancers pay in the UK

When you work for yourself, your relationship with the taxman becomes direct. There is no employer to deduct taxes on your behalf before your pay arrives. Understanding which taxes you are liable for is the essential first step in managing your finances and staying compliant.

As a freelancer or sole trader, you are personally responsible for two main types of tax on your business profits. That’s Income Tax and National Insurance Contributions (NICs). Furthermore, your business and personal income are treated as one for tax purposes.

Income tax explained

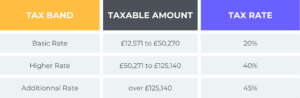

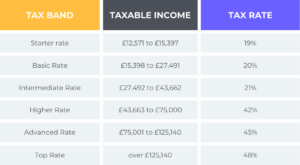

You pay Income Tax on your taxable profits, which is your total income minus your allowable business expenses. For the 2025/26 tax year, you have a personal allowance of £12,570, meaning you pay no tax on the first £12,570 of your profits. The rates that follow differ between Scotland and the rest of the UK.

England, Wales, and Northern Ireland:

Scotland:

National Insurance for freelancers

National Insurance for freelancers is divided into two classes. For the 2025/26 tax year, the rules are straightforward:

- Class 2 NICs: If your annual profits are £6,845 or more, you are treated as having paid these contributions. This protects your entitlement to benefits like the State Pension, and you do not have to pay anything. If your profits are below this threshold, you can choose to pay voluntary contributions (currently £3.50 a week) to maintain your National Insurance record.

- Class 4 NICs: If your profits exceed £12,570, you pay Class 4 contributions at a rate of 6% on profits between £12,570 and £50,270, and 2% on any profits above £50,270.

Registering with HMRC and the self-assessment process

Once you have started your freelance business, your next task is to formalise your status with HM Revenue and Customs (HMRC). The process is straightforward, provided you meet the key deadlines.

When and how to register

You must register for Self-Assessment if your self-employed income exceeds £1,000 in a tax year (running from 6 April to 5 April). The deadline to inform HMRC is October 5th following the end of the tax year in which you started trading. For instance, if you started freelancing in June 2025, you must register by the 5th of October 2026.

You can register online via the HMRC website for self-employed registration. After registering, HMRC will send you a letter containing your 10-digit Unique Taxpayer Reference (UTR) and set up your online account.

Navigating self-assessment

The core of your administrative duties as a freelancer is the annual Self-Assessment tax return. This is the form where you declare all your income, expenses for the tax year, and it’s part of how it’s how to pay tax as a freelancer in the UK.

The critical deadlines are cemented in every freelancer’s calendar:

- 31st October: Deadline for paper tax returns.

- 31 January: Deadline for online tax returns and for paying any tax you owe for the previous tax year.

You must keep clear records of your sales, income, and business expenses throughout the year. This makes filling in your return simpler and provides essential evidence should HMRC have any questions. Note that when you submit your return online, HMRC’s system will typically calculate your tax bill for you.

If your previous year’s tax bill was over £1,000, you will likely need to make ‘Payments on Account’. These are two advance payments towards your next tax bill, each for half of the previous year’s tax liability.

They are due on 31st January and 31st July. Also, any remaining balance is then settled by the following 31st January.

Allowable expenses and tax reliefs for freelancers

One of the most powerful ways to manage your freelancer tax UK bill is through a firm grasp of allowable expenses. These are the ordinary costs of running your business that you can deduct from your total income, thereby reducing your taxable profit.

Common allowable expenses

HMRC allows you to claim a deduction for a wide range of business costs:

- Office costs: Stationery, printer ink, postage, and phone bills.

- Travel costs: Train fares, bus tickets, fuel, parking, and hotel rooms on business trips.

- Staff costs: Salaries for employees, subcontractor costs, and agency fees.

- Raw materials: Stock for resale or materials used to provide your service.

- Financial costs: Bank charges, interest on business loans, and insurance premiums (including professional indemnity insurance).

- Marketing: Website costs, online advertising, and free samples.

- Clothing: Uniforms or protective clothing needed for your work (but not everyday clothing, even for client meetings).

- Training: Courses that relate to and improve the skills or knowledge required for your existing business.

Working from home

If you work from home, you can claim a proportion of your household running costs. However, you must use a reasonable method to calculate the business portion.

For example, if you use one room in a four-room house exclusively for business, you could claim 25% of your heating and electricity costs. You can also use HMRC’s simplified expenses flat rates. They are:

- £45 per month if you work 25-50 hours a month from home.

- £25 for 51-100 hours.

- £24 for 101 or more hours.

Capital allowances

For larger purchases you keep to use in your business, like a laptop, machinery, or a vehicle, you claim capital allowances instead of treating them as a simple expense. This allows you to deduct a portion of the item’s value from your profits each year.

VAT, trading allowance, and other thresholds

Beyond Income Tax and NICs, there are other key thresholds that define your freelance tax landscape.

The VAT threshold

Value Added Tax (VAT) is a consumption tax you charge on your goods and services. You must register for VAT if your annual taxable turnover exceeds £90,000 (for the 2025/26 tax year).

Once registered, you charge VAT at the standard rate of 20% on your invoices, but you can also reclaim the VAT you pay on your business purchases. You then pay the difference to HMRC, usually on a quarterly basis.

The trading allowance

A helpful provision for those with small amounts of income is the £1,000 Trading Allowance. If your annual gross income from self-employment is £1,000 or less, you do not need to declare it or register for Self-Assessment.

If your income is above this amount, you can choose to deduct the £1,000 allowance from your income instead of claiming your actual expenses. It goes a long way toward simplifying your record-keeping.

Tips to minimise tax liability and avoid common mistakes

Staying on top of your tax affairs is not just about compliance, but about making your business as efficient as possible.

Keep impeccable records

The single most important habit is to keep clear and organised records of all your income and expenses. Use a dedicated business bank account, keep all your receipts (digital or physical), and use a spreadsheet or accounting software.

Good records make filling in your tax return simple. They ensure you claim every expense you are entitled to, and are your first line of defence in an HMRC enquiry.

Understand your expenses

Many freelancers under-claim by not knowing what is allowable. You are entitled to claim for the business proportion of costs like home utilities, mobile phone bills, and use of your personal car for business (using simplified mileage rates of 45p per mile for the first 10,000 miles).

Plan for your tax bill

Open a separate savings account and transfer a percentage of every payment you receive (a good starting point is 25-30%) to cover your future tax and National Insurance bills. This prevents the January tax deadline from becoming a financial crisis.

Avoid the common pitfalls

- Missing the registration deadline: Register by 5 October to avoid an automatic penalty.

- Mixing personal and business spending: This makes record-keeping a nightmare, so use a separate business account.

- Forgetting about payments on account: Many new freelancers are caught out by their first large tax bill, which includes a payment on account. Always set aside more than you think you will need.

- Ignoring national insurance: Your contributions count towards your state pension and benefits. If your profits are low, consider making voluntary Class 2 contributions to protect your record.

How Hightekers EOR service can help you ?

Our Employer of Record service at Hightekers, acts as an umbrella company and provides the support the contractor needs, keeping freelancers the freedom to choose their clients and projects without setting up their business entity.

Learn how to stay compliant with UK freelancer taxes

Frequently asked questions

Do I need to register as self-employed if I earn less than £1,000?

No. If your total annual gross self-employed income is £1,000 or less, you do not need to inform HMRC or file a tax return. This is known as the Trading Allowance.

What is the difference between a sole trader and a limited company?

A sole trader is a simple business structure where you and your business are legally the same entity. On the other hand, a limited company is a separate legal entity from its owner.

Most freelancers start as sole traders due to its simplicity, while a limited company can offer different tax planning opportunities and personal liability protection.

Can I be employed and self-employed at the same time?

Yes, this is a common situation. You will pay Income Tax and Class 1 National Insurance on your employment income through PAYE.

You must also register for Self-Assessment to declare your freelance income, on which you will pay Income Tax and Classes 2 and 4 National Insurance.