Managing Payroll in the Netherlands: 2025 Guide for Employers

Understanding what is payroll is the first step to successfully employing people in the Netherlands. Dutch payroll is more than just paying salaries, since it’s a comprehensive system for managing all financial aspects of employment. That’s from calculating gross and net wages to withholding and remitting taxes, all while ensuring strict compliance with local laws.

For any business, grasping the intricacies of payroll in the Netherlands is not optional. In fact, it’s essential for legal operation and building a trusted workforce.

This payroll guide will walk you through everything from the fundamental meaning of payroll and the legal registration process to the specific tax rates for 2025. Consider this your foundational resource for managing your fiscal responsibilities as an employer in the Dutch market.

What does payroll mean in the Netherlands?

In the Netherlands, what is payroll encompasses the entire process of administering your employees financial compensation. It involves:

- Calculating gross salary

- Making mandatory and voluntary deductions

- Arriving at the net salary that your employee takes home

- Ensuring all withheld amounts are paid to the correct authorities

For an employer, it is your primary mechanism for meeting your tax and social security obligations.

The core of this process hinges on understanding two key concepts: gross salary and net salary. Gross salary is the total agreed-upon compensation before any deductions are made. Whereas net salary, often referred to as ‘take-home pay’, is the amount the employee receives after all deductions. The difference between the two consists of various withholdings, primarily wage tax and social security contributions.

A functioning Dutch payroll system typically manages these key components:

- Gross salary: The base salary, along with any bonuses, overtime pay, holiday allowance (typically 8% of the annual salary), and the often-mentioned 13th-month payment.

- Wage tax (Loonbelasting): This is an advance payment on your employee’s income tax. You, as the employer, are responsible for withholding it from their salary.

- Social security contributions: These are mandatory contributions that fund the Dutch social security system. This includes national insurance for state pensions and long-term care, as well as employee insurance for unemployment and disability.

- Employee benefits: Deductions or employer contributions for benefits such as pension schemes, housing allowance, health insurance, and other collective arrangements.

Understanding this structure is the first step. The next is knowing how to legally set up your business to perform these tasks.

Legal and registration requirements for employers

Before you can process your first pay slip, you must formally establish your business as a recognised employer in the Netherlands. This process involves several key registrations with Dutch authorities to ensure you are operating within the legal framework.

Your first point of contact should be the Dutch Chamber of Commerce (Kamer van Koophandel or KvK). Every business operating in the Netherlands must register here to obtain a unique KvK number, which is essential for all your official dealings.

Following your business registration, you must specifically register as an employer with the Dutch Tax and Customs Administration (Belastingdienst).

It is through this registration that you will receive your crucial payroll tax number (loonheffingennummer). You will need this payroll tax number for all your communications with the tax office, for filing returns, and for making payments. The registration process can be initiated using the ‘Registration Form Foreign Companies’ if your company is based outside the Netherlands.

Ongoing administrative obligations

Once registered, you have several ongoing administrative obligations:

- Verify employee identity: You must check every employee’s identity and collect their Citizen Service Number (Burgerservicenummer). For foreign workers, you also need to verify their right to work in the Netherlands.

- Create employment contracts: Draft contracts that comply with Dutch law, clearly outlining salary, working hours, and other terms.

- Maintain accurate records: Keep a detailed payroll administration, including records of hours worked, salaries paid, and taxes withheld. That’s because Dutch law requires you to retain these records for at least seven years.

Payroll taxes and social contributions in 2025

Understanding the landscape of taxes and social contributions is a central part of managing payroll. The Dutch system is progressive and funds a comprehensive social security net. For the year 2025, employers and employees must contend with a set of defined rates and contributions.

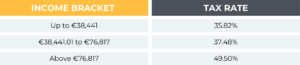

The primary deduction from an employee’s salary is the wage tax. This is a progressive tax, meaning the rate increases as the employee’s income rises. For 2025, the wage tax brackets are as follows:

These rates apply to both residents and non-residents working in the Netherlands.

Dutch social security system

Beyond income tax, the Dutch social security system is funded through two main types of contributions: national insurance and employee insurance.

- National insurance contributions (Volksverzekeringen): These are withheld from the employee’s salary and cover schemes that protect all residents against life events. They include the General Old Age Pensions Act (AOW), the Surviving Dependants Act (Anw), and the Long-Term Care Act (Wlz).

- Employee insurance contributions (Werknemersverzekeringen): These are contributions that insure employees against work-related risks. As the employer, you bear the full cost of these. They cover the Sickness Benefits Act (ZW), the Invalidity Insurance Act (WAO)/Work and Income according to Work Capacity Act (WIA), and the Unemployment Insurance Act (WW).

- Healthcare insurance act (Zvw): Employers are also required to contribute to the healthcare insurance fund. For 2025, the employer contribution rate is 6.52%, which is capped at a certain annual income level.

Other schemes

The Dutch system also offers some notable schemes that can affect payroll calculations:

- The 30% ruling: This is a tax advantage for highly skilled migrants recruited from abroad. If the conditions are met, you can pay up to 30% of their salary as a tax-free allowance. It effectively reduces their taxable income and your associated payroll tax burden.

- Work-related costs scheme (WKR): This scheme allows you to reimburse certain costs. For example, travel expenses or a work computer are provided to your employees tax-free. That’s up to a certain percentage of your total payroll.

Payroll filing, withholding, and reporting obligations

Once your payroll system is active, you enter a cycle of regular filing and reporting. The Dutch system is built on a self-assessment principle. That’s where the employer is responsible for calculating, withholding, and remitting the correct amounts on time.

The standard payroll cycle in the Netherlands is monthly. By the last day of each month, you must provide your employees with a detailed pay slip. Crucially, you are also required to file a monthly payroll tax return with the Dutch Tax Administration and pay the total amount of withheld wage tax and social security contributions for that period.

This deadline is typically the last day of the month following the reporting period.

Key reporting obligations

Your key reporting obligations include:

- Monthly payroll tax return: You must declare and pay the total withheld taxes and contributions for all employees each month.

- Annual Statement (Jaaropgave): By the end of January each year, you must provide each employee with an annual summary of their total gross salary, withheld wage tax, and social security contributions for the previous year. This document is essential for employees to file their personal income tax returns.

- Annual reporting to tax authorities: You must also submit an annual summary of payroll information for all employees to the Tax Administration.

The Dutch Tax Administration provides online portals and accepts filings through certified payroll software to facilitate this process. Failure to meet these deadlines can result in significant penalties and interest charges.

Employee rights and mandatory benefits

The Dutch labour model is designed to protect workers with a strong set of statutory rights and benefits. A strong payroll in the Netherlands must accurately account for and facilitate these entitlements. Understanding these rights is not just about compliance, but fostering a positive and sustainable employment relationship.

- Minimum wage: The Netherlands has an hourly minimum wage for employees aged 21 and over, which is adjusted twice a year. As of 2025, the hourly minimum wage is €14.40.

- Holiday allowance: Virtually all employees are legally entitled to a holiday allowance (vakantiegeld), which is at least 8% of their gross annual salary. This is typically accrued throughout the year and paid out in one lump sum, often in May or June.

- Paid annual leave: Full-time employees are entitled to a minimum of four times their weekly working hours in paid holiday leave each year. This typically translates to at least 20 days per year. However, many collective labour agreements (CAOs) offer more.

- Sick leave: The Dutch system provides extensive protection for ill employees. Note that employers are required to continue paying at least 70% of the employee’s salary for a period of up to 104 weeks (two years). Furthermore, during the first two years of illness, the employer is responsible for reintegration efforts.

- Maternity and paternity leave: Female employees are entitled to 16 weeks of fully paid maternity leave. Also, partners are entitled to five days of paid paternity leave at 100% of their salary, followed by an additional five weeks of leave paid at 70% of their salary.

- Severance pay: Employees dismissed after two years of service are generally entitled to a transition compensation (transitievergoeding). This is a statutory severance payment calculated based on the employee’s tenure and salary.

Collective Labour Agreements

In the Netherlands, a Collective Labour Agreement (CAO) is a legally binding contract negotiated between trade unions and employers associations. They set employment terms for a specific sector or company.

These agreements build upon the foundation of Dutch law. That’s because they establish conditions for workers regarding wages, bonuses, holiday allowances, overtime regulations, and pension contributions. Also, CAOs often provide more generous annual leave, higher severance pay, and detailed procedures for conflict resolution than the statutory minimums.

While not every industry has one, once declared universally applicable by the government, a CAO becomes mandatory for all employers and employees within that sector. This ensures a level playing field and standardised benefits. For businesses, adhering to the relevant CAO is a critical compliance requirement.

Final thoughts

Figuring out the complexities of Dutch payroll demands significant expertise and administrative rigour. It includes everything from the intricate tax tiers and social contributions to stringent reporting and employee rights under CAOs.

For businesses, especially those expanding internationally, maintaining full compliance while focusing on core growth strategies can be a substantial challenge. This is where partnering with Hightekers becomes a strategic advantage. Our EOR service acts as the legal employer for your workforce, tax withholding, and adherence to local labour laws.

This allows you to seamlessly hire and manage talent in the Netherlands without establishing a local entity.

Get started with your Netherlands business expansion

Frequently asked questions

What is a payroll tax number and how do I get one?

A payroll tax number (loonheffingennummer) is a unique identifier issued by the Dutch Tax Administration when you register as an employer. You need this number to file your payroll tax returns and for official correspondence.

Note that you receive it after registering your business, either directly or via a form for foreign companies.

What deductions am I legally required to make from salary?

You are legally required to withhold wage tax (an advance on income tax) and national insurance contributions from your employees gross salaries. These deductions are mandatory and do not require the employee’s separate permission. You then remit these withheld amounts directly to the Dutch Tax Authorities.

Are foreign companies without a Dutch entity required to run payroll?

Yes, if you have an employee performing work in the Netherlands, you may trigger a “withholding agent” obligation. This requires you to register with the Dutch tax office and run a compliant Dutch payroll.

It applies even if your company is based entirely outside of the Netherlands, to ensure proper taxation of the work done within the country.

How frequently do I run payroll for employees in the Netherlands?

The standard payroll cycle in the Netherlands is monthly. You must calculate salaries, deduct taxes and social contributions, and provide payslips by the end of the month.

Additionally, the corresponding payroll tax return and payment to the tax authorities are due by the end of the following month.

What are my obligations if an employee is on sick leave?

During employee illness, you must continue paying at least 70% of their salary for up to 104 weeks (two years). You are also legally obligated to support their reintegration into the workplace.

This involves consulting with an occupational health service and creating a plan for their return to work.

How does the 30% ruling simplify payroll for foreign employees?

The 30% ruling allows you to pay a tax-free allowance equivalent to 30% of a qualifying foreign employee’s salary. This means you withhold payroll tax on only 70% of their gross salary.

Overall, simplifies calculations and provides a significant financial benefit that aids in attracting international talent to the Netherlands.

Is a Collective Labour Agreement mandatory for my business?

If your business operates in a sector where a CAO has been declared universally binding, you must adhere to it. Otherwise, it is not mandatory unless you voluntarily choose to be bound.

Note that CAOs often set industry standards for benefits and wages that are above the legal minimum.

What is the annual payroll reporting deadline in the Netherlands?

You must provide each employee with an annual statement (jaaropgave) summarising their income and tax withholdings by the end of January.

The corresponding annual declaration for the tax authorities (jaaropgaaf) is also due electronically by the end of February each year for the previous calendar year.