The Ultimate Guide to Freelance Insurance in 2026

Let’s be frank, the freelance life is a beautiful paradox. It offers unparalleled freedom—the liberty to choose your projects, set your own hours, and work from a sun-drenched cafe in Lisbon or your quiet living room in Berlin.

But this freedom is underpinned by a fundamental vulnerability that traditional employees simply don’t face. While they enjoy a safety net woven by their employer—sick pay, private health coverage, pension contributions—you are the entire organisation.

You are the CEO, the marketing department, the IT support, and the risk manager. This is where the concept of freelance insurance transitions from a vague “should-have” to a non-negotiable pillar of your professional infrastructure.

Freelancer insurance overview

Freelance insurance is a suite of protective financial products designed to shield you from the specific perils of working for yourself. It’s the buffer between an unforeseen catastrophe and your business’s survival.

Think about the unique risks you navigate daily:

- A client could allege your work caused them financial loss

- A prolonged illness could strip you of your income for months

- Your expensive laptop and professional camera gear could be stolen from a co-working space

Without the corporate umbrella, you are exposed to these financial downpours. However, freelance insurance is your custom-built shelter. It matters because it transforms risk from a terrifying unknown into a manageable, calculated factor. It’s the foundation upon which a resilient, sustainable, and truly free freelance career is built.

Types of freelance insurance

Understanding the world of insurance can feel like deciphering a foreign language, but it becomes much simpler when you break it down into its core components. Your specific needs will depend on your industry, location, and personal circumstances.

Freelance health insurance

For many international freelancers, this is the most immediate and pressing concern. If you’ve moved from a country with a national health service, navigating healthcare in a new nation can be complex. You may find the public system overburdened or not covering all your needs.

Freelance health insurance is a private medical plan you secure for yourself and your dependents. It provides access to:

- Quicker specialist appointments

- Private hospital rooms

- Wider range of treatments

For a freelancer, time is income, so being able to bypass long waiting lists for a necessary surgery or consultation is a business continuity strategy.

Understanding how to get health insurance as a freelancer is a critical first step in establishing your professional and personal life abroad. A good freelancer medical plan offers portability and flexibility, essential for a mobile international lifestyle.

Professional indemnity insurance

This is the cornerstone of freelance business insurance for knowledge workers, such as remote consultants, designers, developers, writers, and marketers. Imagine you provide a client with strategic advice that they follow, leading to a significant financial loss.

Or, you deliver a website design that accidentally infringes on a copyright. The client decides to sue you for damages. Professional Indemnity (PI) insurance covers your legal defence costs and any damages you are required to pay.

Also, it protects you against claims of negligence, errors, or omissions in the professional services you provide. In many industries, clients now require you to have PI coverage before they will even sign a contract.

Public liability insurance

While PI covers financial or reputational harm, public liability insurance covers physical injury or property damage. If a client visits your home office, trips over a cable, and breaks their wrist, this insurance has you covered.

If you’re a photographer and you accidentally knock over and shatter an expensive vase at a client’s location during a shoot, public liability would handle the claim. It’s especially important for freelancers who interact with the public or work on client premises.

Business equipment insurance

Your tools are your livelihood. For the modern freelancer, this is rarely a physical workshop but a curated collection of essential technology and gear. A standard home contents policy often explicitly excludes items used for business purposes, or provides coverage that is woefully inadequate for their replacement value.

Business equipment insurance (also known as business contents or gadget insurance) is designed to fill this critical gap. Here are examples of what a typical business equipment insurance policy covers:

- Laptops, monitors, and computers stolen during a burglary at your home office.

- A professional camera and lenses damaged after being accidentally dropped on a client’s location.

- Your smartphone that is cracked or becomes unusable due to liquid damage.

- Loss or theft of a tablet and its accessories while you are travelling for work.

- Damage to peripheral devices like printers or scanners caused by an electrical surge.

- The cost of data recovery services following the loss or damage of your insured equipment.

Income protection insurance

This is your personal safety net and arguably one of the most critical policies for any freelancer. What happens if a serious illness or injury prevents you from working for three, six, or twelve months?

Your bills won’t stop, but your income will. Income protection insurance provides you with a regular, tax-free payment. It’s a long-term solution that supports you until you are able to return to work.

It is the ultimate form of financial self-care, ensuring that a health problem does not spiral into a catastrophic debt problem.

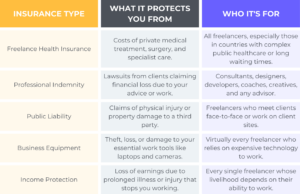

A freelancer’s guide to core insurance types

Why freelancers need insurance in 2026

The freelance economy isn’t just growing, but it’s maturing and becoming more complex. Here are the top reasons why insurance should be top-of-mind:

- Professionalism: Operating without adequate insurance signals amateurism and can immediately disqualify you from lucrative contracts. In a competitive international market, robust freelance business insurance is a credential that builds immediate trust and positions you as a serious partner.

- Economic volatility: Unlike salaried employees, you have no sick pay or severance package. Income protection insurance acts as your private safety net. It ensures a prolonged illness or injury doesn’t derail your finances and provides stability in an uncertain world.

- Protected equipment: The “creator economy” relies on expensive, portable technology. A stolen laptop or damaged camera isn’t just an inconvenience, but an immediate work stoppage. Business equipment insurance ensures a single incident doesn’t halt your income, allowing for rapid replacement and seamless business continuity where time is money.

- Liability exposure: The blurred line between personal and professional life increases liability exposure. A client injured in your home office or a data breach on your personal laptop can have serious consequences. Insurance creates a crucial legal and financial firewall, protecting your personal savings from business-related claims.

- Health: Freelance health insurance is critical for international workers. Navigating foreign public systems can be daunting, with potential language barriers and long waits. A private medical plan offers swift access to care, getting you back to work faster and providing vital peace of mind while abroad.

How to choose the right freelance insurance

Selecting the right insurance isn’t about finding the most expensive policy or the cheapest one. Instead, it’s about finding the one that fits your unique risk profile. A one-size-fits-all approach is a recipe for being either over-insured or dangerously under-protected. Follow this strategic process to make an informed choice.

1. Conduct a thorough risk assessment

Before you look at a single policy, look inward. Grab a notebook and honestly assess your vulnerabilities. What are the biggest threats to your business? Are you a software developer whose code could crash a client’s e-commerce platform? Your primary risk is professional indemnity.

Are you a personal trainer who works with clients in a gym? Public liability is your non-negotiable. Do you have a family history of a specific illness? This makes freelance health coverage a priority.

Also, list your assets: your physical equipment, your future earning potential, and your personal savings. This audit will illuminate exactly what you need to protect.

2. Understand policy details, not just the price

When comparing policies, look beyond the premium and examine the key clauses. What is the excess (the amount you pay out of pocket on a claim)? A lower premium might come with a £500 excess, making it pointless for a £600 claim.

Also, what are the coverage limits? Is it £1 million for professional indemnity, or £5 million? Then, check for exclusions—specific situations the policy will not cover. For income protection, the length of the deferral period and the policy’s definition of “unable to work” are critical. A good broker or a careful reading of the policy document is essential here.

3. Budget realistically for your coverage

Insurance is a necessary operating cost, like your internet bill or your accounting software. It should be factored into your business expenses from the start. Determine how much you can comfortably allocate each month without straining your finances.

Remember, it’s a balancing act. It’s better to have a fundamental professional indemnity policy with a manageable premium than to have no policy at all because the “comprehensive” plan was too expensive.

Start with the coverage you absolutely need—often PI and equipment—and build from there, adding health and income protection as your business becomes more profitable.

Finally, researching how to get health insurance as a freelancer through international providers can reveal a range of options at different price points.

Tips for managing freelance insurance costs

Securing comprehensive coverage doesn ‘t have to bankrupt you. With a few savvy strategies, you can often reduce your premiums while maintaining the robust protection:

- Consolidate your core policies, such as professional indemnity and public liability, into a single Business Owner’s Policy (BOP). Insurers frequently offer a significant discount for bundling these covers together.

- Investigate membership with professional bodies, freelancer unions, or industry associations. These groups often negotiate exclusive, discounted group insurance schemes for their members. The savings on your freelance health insurance or liability cover can far outweigh the minimal cost of joining the organisation itself.

- Opting for a higher voluntary excess can substantially reduce your annual premium. By agreeing to pay more upfront towards a claim, you demonstrate lower risk to the insurer. Just ensure the excess amount remains at a level you can comfortably afford in an emergency.

- Diligently review your policies annually to ensure they reflect your current business state. As your income grows or you acquire new equipment, update your covers. A claim-free history may also make you eligible for new discounts, and shopping around at renewal can secure better rates.

- Maintain a claim-free record by prioritising risk management in your daily operations. Use robust contracts, implement strong data security, and maintain your equipment properly.

Final thoughts

In the dynamic world of freelancing, your talent is your greatest asset, but it is also your sole source of income. Viewing insurance as an unnecessary expense is a perilous miscalculation. In reality, it is the fundamental infrastructure that protects your earning potential and grants you the freedom to innovate and grow without fear.

Furthermore, if you want to simplify the complexity of compliance, tax filings, and client invoicing, Hightekers offers a smarter alternative. Through our employment model for freelancers, Hightekers acts as your legal employer. This means we’ll manage payroll, taxes, and compliance in your country of residence.

Also, by joining Hightekers, freelancers can enjoy the benefits of an employee, including financial security and health insurance, and keeping the freedom of choosing their own clients and projects.

Are you ready to simplify your freelancing career?

Discover how Hightekers can simplify your tax and compliance journey

Frequently asked questions

Is freelance insurance legally required?

For most professions, freelance insurance is not a legal requirement. However, it can be a contractual one. Many clients, particularly larger corporations and government bodies, will insist you have professional indemnity insurance written into your contract.

Can I get freelance insurance if I travel frequently?

Yes, but you must be transparent about your circumstances. Many standard policies have geographical limits, so if you plan to work abroad for extended periods, you need a policy that offers worldwide coverage.

This is particularly important for freelance health insurance, where international coverage is a key feature of plans designed for expats and digital nomads. Always declare your travel plans to your insurer.

How quickly can I get covered?

The process is typically very fast. For many core business insurance types like professional indemnity and public liability, you can often get an instant quote online and receive your certificate of insurance within hours or a few days.

For health and income protection, the process may involve a more detailed medical questionnaire and can take a few weeks to be fully underwritten and put in place.