Sick Leave in the Netherlands: Rules, Rights, and Employer Obligations in 2026

For companies employing talent in the Netherlands, understanding the local approach to sick leave is a legal requirement. Dutch labour law presents a framework that places responsibilities on employers while offering strong protections for employees.

The system is built on a fundamental principle: if an employee is sick, they are expected to stay home to recuperate, without fear of losing their income or their job. This article explains the critical rules for sick leave in the Netherlands, outlining what both employees and employers need to know about rights, obligations, and the calculation of sick pay.

What is sick leave in the Netherlands?

In the Netherlands, sick leave is a right designed to provide job protection and income security when an employee is unable to work due to illness. If you are sick and unable to work, you have the right to stay home and recuperate, while still receiving your wages.

This approach is culturally embedded, since calling in sick is not generally frowned upon. Employers and the law expect you to stay home if you are unwell.

The philosophy is that proper recovery benefits both the employee and the employer in the long run. Everyone, from those on permanent contracts to those on temporary contracts, benefits from the same two-year entitlement.

The key principles of the Dutch system are:

- Stay home if you’re sick: It is the expected course of action.

- Income protection: Employees continue to receive a percentage of their salary for up to two years.

- Job security: Employers cannot simply dismiss an employee for being ill.

- Active reintegration: Both employer and employee must work together to facilitate a return to work.

Employee rights during sick leave

Employees in the Netherlands enjoy strong protections during periods of illness, ensuring they can focus on recovery without financial or professional anxiety.

The right to paid leave and job protection

The cornerstone of employee rights is the entitlement to sick pay in the Netherlands. By law, employers must continue to pay at least 70% of an employee’s last earned wages for a maximum of 104 weeks (two years).

During the first year of illness, this 70% must be at least the amount of the Dutch minimum wage. In the second year, it can fall below this threshold. Many companies offer more generous terms through collective labour agreements (CAOs) or individual contracts, such as paying 100% of the salary for an initial period.

Critically, your job is protected. Your employer is not allowed to simply dismiss you during your sick leave. They must follow normal, and often stringent, procedures for terminating an employment contract.

Reporting sick and medical privacy

If you fall ill on a working day, you must report it to your employer as soon as possible, following your company’s formal process. A key privacy protection under Dutch sick leave rules is that you are not obliged to disclose the nature of your illness, and your employer is not permitted to ask. They are, however, allowed to ask when you think you might be able to return to work.

A common question is whether a doctor’s note is needed. Generally, you do not need a doctor’s certificate to call in sick. However, all companies are required to use an Occupational Health and Safety Service.

If your illness extends beyond a few days, the Arbodienst or a company doctor (bedrijfsarts) may contact you. The bedrijfsarts is an external professional tasked with facilitating your recovery and return to work, not with sharing medical details with your employer.

Special cases: Long-term illness and mental health

The two-year entitlement applies to all illnesses, including long-term conditions and mental health issues such as burnout. Burnout is taken seriously in the Netherlands and is considered a valid reason for taking sick leave in the Netherlands.

After two years of illness, if you are still unable to work, the situation changes. Your employer may then terminate your contract, and you may become eligible for government sickness benefits through the UWV, specifically under the Work and Income Act.

Employer obligations

Dutch labour law imposes a clear and demanding set of duties on employers when an employee falls ill. Proactive and documented compliance is essential to avoid significant financial penalties.

Continued payment of wages and record-keeping

The most immediate obligation is the continued payment of wages. As outlined, this means paying at least 70% of the employee’s salary for up to two years. This obligation applies to employees on permanent contracts, fixed-term contracts, and on-call workers.

Furthermore, meticulous record-keeping is vital. Employers must maintain a return-to-work report that records all agreements, activities, action plans, and reintegration reports.

The reintegration process

An employer’s responsibility goes far beyond writing cheques when hiring in the Netherlands. They are legally required to actively cooperate with the employee to enable a return to work “as quickly as possible in a responsible way.” This process, known as reintegration, is a structured effort.

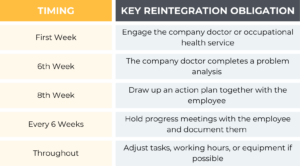

The following table summarises the key reintegration steps and timelines an employer must follow:

The goal is to return the employee to their original role or, if that is not feasible, to find suitable alternative work within the company or even with another employer. Note that the employer bears the costs associated with this reintegration.

Notifications and legal risks

Employers must notify the Arbodienst when an employee reports sick. For illnesses lasting longer than 42 weeks, the Employee Insurance Agency (UWV) must be notified. The consequences for neglecting these reintegration obligations are severe.

If an employer fails in their duties, the UWV can impose a wage sanction, forcing the employer to pay wages for an additional 52 weeks on top of the standard 104 weeks. In serious cases, the employee may also be entitled to claim substantial fair compensation from the employer, with court awards reaching tens of thousands of euros.

How sick pay is calculated

Understanding the calculation of sick pay is crucial for both employers managing payroll and employees planning their finances during absence.

Standard calculation rules

The foundational rule is that an employee on sick leave in the Netherlands receives at least 70% of their normal wages for up to two years. This calculation includes not just the base salary but also at least 70% of all regular wage components the employee would have received. This includes overtime pay, personal allowances, and other benefits.

The calculation is typically broken into two phases:

1. First year of illness: You pay 70% of the employee’s salary, and you must supplement this amount if it falls below the legal minimum wage.

2. Second year of illness: You still pay 70% of the salary, but there is no obligation to top it up to the minimum wage level.

It’s worth noting that employers are permitted to use up to two “waiting days” at the start of the sickness absence, meaning sick pay does not have to start from the very first day.

Variations by employment type

- Pregnancy and organ donation: If the sick leave is due to pregnancy, childbirth, or organ donation, the employer must pay 100% of the normal wages.

- On-call employees: For workers on zero-hours contracts, the employer must continue to pay if the employee falls ill during a period they were called up to work. Payment continues until the agreed on-call period ends.

- End of contract: If a fixed-term contract ends while the employee is still ill and before the two years are up, the employer’s obligation to pay wages stops. The employer must report the employee’s illness to the UWV on the last day of the contract, and the employee may then be eligible for UWV sickness benefits.

How an EOR can help

Dutch sick-leave obligations are complex and employer-heavy, so an Employer of Record service can help for employees and employers alike. The EOR is particularly relevant for companies whose employees want to relocate to the Netherlands but who do not have a Dutch legal entity to manage these obligations.

A trustworthy EOR:

- Acts as the legal employer in the Netherlands, ensuring full compliance with Dutch labour law

- Handles statutory sick pay obligations — including long-term sick pay (up to 104 weeks)

- Manages all required communication with Dutch authorities, occupational health services (Arbodienst), and reintegration processes

- Provides compliant Dutch employment contracts and ensures correct payroll tax and social security contributions

- Reduces employer risk related to illness, reintegration failures, worker misclassification, or non-compliance penalties

- Allows companies to legally employ workers based in the Netherlands without needing to set up a local entity or navigate Dutch sick-leave rules independently

Final thoughts

Dealing with the Dutch sick leave system requires meticulous attention to legal detail, from calculating sick pay to managing the complex two-year reintegration process. For international companies, non-compliance carries significant financial and legal risks. Hence, partnering with Hightekers offers a strong solution.

By acting as your Employer of Record (EOR) in the Netherlands, Hightekers assumes full legal responsibility for your talent, ensuring strict adherence to all sick leave rules. This allows you to focus on your business objectives while remaining fully compliant with the stringent labour laws in the Netherlands.

Contact Hightekers for sick leave in the Netherlands

Frequently asked questions

Can my employer fire me while I am on sick leave?

No, your employer cannot simply dismiss you for being ill. They are prohibited from terminating your employment contract during sick leave.

They must follow the normal legal procedures for dismissal, which are strict. After two years of illness, the employer gains the possibility to terminate the contract.

What happens if I am sick during my holiday?

If you become sick during your scheduled holiday and you inform your employer directly, it is possible to have those days reclassified as paid sick leave instead of holiday leave. This allows you to preserve your valuable holiday entitlement for when you are actually healthy and able to enjoy it.

What are my obligations as a sick employee?

You must actively cooperate with your own reintegration. This includes discussing your health with the company doctor, attending progress meetings with your employer, helping to draw up and approve the action plan, and accepting any suitable work that is offered to you.

Failure to cooperate can lead to a suspension of your salary or even dismissal.