What Is the Average Salary in the UK Today?

In a nation where discussing salaries can feel more taboo than politics or religion, it’s a good idea to look at the data on the average salary in the UK. Professionals looking for work can set realistic expectations, and businesses can make budget calculations on their payroll costs.

This guide cuts through the noise to give you a clear, data-driven picture of UK earnings in 2025. We’ll move beyond that single headline number to explore what you can realistically expect to earn in your field.

Overview of average wage in the UK

Understanding the average income in the UK requires looking at two different measures: the mean and the median. The mean average, which is the total sum of all salaries divided by the number of workers, can be skewed upwards by a relatively small number of very high earners.

The median, often considered a more accurate reflection of typical earnings, is the point at which half of all workers earn more and half earn less.

According to the latest official data, the median full-time average salary in the UK stands at £37,430 per year. When expressed as a weekly figure, the Office for National Statistics (ONS) reports that average weekly earnings were estimated at £733 for total pay (including bonuses) and £682 for regular pay (excluding bonuses) in August 2025.

Several key factors pull the strings behind your paycheck:

- Profession and industry: The sector you work in is one of the most significant determinants of your pay.

- Age and experience: Earnings tend to peak in the 40-49 age bracket, reflecting the value of accumulated experience and skills.

- Geography: There is a pronounced “London effect,” with salaries in the capital significantly outstripping those in other parts of the country. That’s even after adjusting for the higher cost of living.

- Hours worked: A stark divide exists between full-time and part-time workers. The median salary for full-time employees is £37,430, compared to £13,910 for their part-time counterparts.

Average salary in the UK by profession

Your career choice is arguably the single biggest factor that decides your earning potential. The landscape of employee wages in the UK reveals dramatic variations. That’s from the highly lucrative fields of finance and surgery to the often undervalued essential work in hospitality and care.

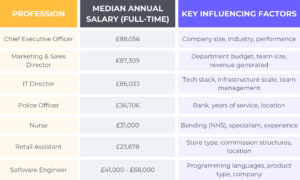

The following table showcases the average salary by profession in the UK for a selection of high-demand roles, illustrating the vast differences across the job market.

It’s also crucial to understand the public versus private sector dynamic. As of June to August 2025, annual average regular earnings growth was 6.0% for the public sector, compared to 4.4% for the private sector. While this indicates stronger recent growth for public sector roles, the base level of pay can vary significantly depending on the specific profession.

Salaries in the UK by region

The old adage that location is everything holds profoundly true for UK salaries. The economic gravity of London and the South East creates a dramatic geographical split in earnings across the country, profoundly affecting income levels for workers in different postcodes.

London

The data shows that London is in a league of its own. The average monthly pay for a worker in the capital is £2,960, which is significantly higher than anywhere else in the UK. To put this into perspective, the median weekly income before housing costs is £735 in London, compared to just £553 in the West Midlands.

This “London weighting” is a deliberate adjustment to help offset the city’s notoriously high cost of living, though the debate rages on over whether it is sufficient.

Outside of London

After London, the areas with the highest pay are typically in the Greater South East, including Reading, Crawley, Slough, and Cambridge. The average annual salaries in the Greater South East are £12,800 higher than in the lowest-paying areas.

Conversely, the lowest average monthly pay in the UK is found on the Isle of Wight, at £2,170. Other areas such as Cornwall, Leicester, Blackburn, and Blackpool also feature amongst the lowest earners.

This regional disparity is driven by a complex mix of factors, including the concentration of high-paying industries (like finance and tech) in the capital, historical underinvestment in regional economies, and differences in productivity.

Cost of living vs salary in the UK

Earning a salary is one thing, but what that salary allows you to do is another. The crucial relationship between what you earn and what you spend determines your quality of life. While a high salary in the UK in 2025 might look impressive on paper, its real value is only revealed when held up against the cost of living.

The good news is that, after a challenging period, real-term wages are growing. In real terms (adjusted for inflation), annual regular pay growth was 0.6% from June to August 2025. This means that on average pay is now growing slightly faster than prices. This offers some relief after a period where inflation was eroding the value of wages.

Expenses

However, this average conceals a wide variation in individual experience. The single largest monthly expense for most people is housing. Renting a one-bedroom flat in central London can easily cost over £1,700 per month, while a similar property in cities like Liverpool or Glasgow might be found for under £700.

This stark difference in rent alone can swallow a much larger portion of a London salary, even if that salary is higher.

When considering a job offer or a move, it’s therefore essential to think about your disposable income. It’s what’s left after tax, national insurance, pension contributions, and essential living costs.

For example, a £40,000 salary in the North East may afford a more comfortable lifestyle, with money left for savings and leisure, than a £50,000 salary in London. That’s where transport, housing, and socialising command a premium.

Salary trends and economic outlook in the UK

The landscape of UK earnings is not static. Also, understanding the trajectory of employee wages can help you gauge the climate for pay rises and plan your career moves.

- Growing wages: After a prolonged squeeze, real wage growth has returned. With nominal pay rising at 4.7% and inflation cooling, real regular pay has increased by 0.6%. This means pay is finally growing faster than prices, offering tangible financial relief to employees and improving living standards after a difficult period.

- Accommodation & food services: The accommodation and food services sector has experienced some of the strongest pay growth. This surge is likely a market correction driven by intense competition for staff and efforts to attract workers in a tight post-pandemic labour market.

- Finances & business: In contrast, the finance and business services sector has seen the lowest annual pay growth at just 2.9%. This indicates a slowdown in one of the UK’s highest-paying industries.

- Unemployment: The UK unemployment rate has risen to 4.6%, the highest since the pandemic. However, the Office for Budget Responsibility forecasts a decline to 4.4% by end-2025. A tightening labour market typically boosts wage bargaining power for employees as competition for talent intensifies.

- Future outlook: Looking ahead, a key trend for the salary in the UK 2025 will be the demand for specialised digital skills. Roles in AI, cybersecurity, and data science are expected to command significant premiums.

Highest paying jobs in the UK in 2025

For those whose primary career motivation is financial reward, targeting certain high-paying professions is the most direct route. These roles typically demand advanced education, specialised expertise, and a high level of responsibility. However, they offer significant financial compensation in return.

Based on the latest data, the highest-paying jobs in the UK are dominated by C-suite executives, specialist medical professionals, and senior roles in technology and finance.

- Chief executives and senior officials: Topping the list are CEOs, with a median salary of £88,056. These individuals hold ultimate responsibility for a company’s strategy and performance, and their compensation reflects that immense accountability.

- Marketing, sales, and advertising directors: Just behind are directors in these commercial fields, earning a median of £87,309. Their high pay underscores the critical importance of driving revenue and brand growth.

- Information technology directors: With businesses increasingly reliant on digital infrastructure, IT directors command a median salary of £86,033. They are responsible for an organisation’s entire technological strategy and security.

- Aircraft pilots and air traffic controllers: These highly skilled professionals, responsible for passenger and crew safety, earn a median of £80,414. The role requires extensive training and licensing.

- Specialist medical practitioners: This category includes roles like surgeons, psychiatrists, and anaesthetists. They have a median salary of £74,979, with many earning far more, especially in private practice.

Final thoughts

Your earnings are profoundly shaped by your profession, geographic location, and the broader economic climate. While the return to real wage growth is a positive sign, understanding your own value means looking beyond the national average.

Consider the intricate balance between your salary, local cost of living, and career trajectory to make informed decisions that truly support your financial and professional aspirations.

Ready to navigate the UK job market with confidence? Whether you are a professional seeking a competitive international package or a business looking to expand to the United Kingdom, our employer of record service is the best option.

Discover how our EOR services can unlock your potential

Frequently asked questions

What is a good salary in the UK for a comfortable life?

A comfortable salary is highly dependent on your location and lifestyle. Outside of London, a single person earning £30,000-£35,000 can live comfortably, covering rent, bills, leisure, and savings.

In London, due to much higher housing and transport costs, a salary of £45,000-£50,000 is often needed to achieve a similar standard of living.

How much does the average person take home after tax?

Your take-home pay depends on your salary and pension contributions. For example, on a £35,000 annual salary, with a standard tax-free Personal Allowance of £12,570, you would pay approximately £4,486 in income tax and £2,692 in National Insurance.

This would leave you with a monthly take-home pay of around £2,318.

Is the UK average salary enough to live on in 2025?

Yes, the average salary is designed to be a livable wage. With the median full-time salary at £37,430, individuals across most of the UK can manage their living costs.

However, in high-cost areas like London, this becomes much more challenging, particularly for those supporting a family on a single income. Hence, budgeting is essential, as is understanding your local cost of living.