What Is the Average Salary in the Netherlands Today?

- Overview of average salary and wage in the Netherlands

- Salary levels by profession and industry

- Regional salary differences across the Netherlands

- Cost of living compared to salaries

- Minimum wage and worker rights in the Netherlands

- Salary trends and forecast for 2025

- Final thoughts

- Frequently asked questions

For both professionals and businesses, understanding salary landscapes in the Netherlands is crucial for making informed decisions. For employees and expats, it provides the knowledge needed to navigate career moves and negotiate fair compensation.

Whereas companies looking to hire can use reliable salary data as the bedrock of creating attractive offers, controlling costs, and successfully competing for top talent in a skilled market.

This article will explore the key factors shaping earnings, from profession and experience to regional variations. Hence, it will provide the context you need to effectively analyse the Dutch job market.

Overview of average salary and wage in the Netherlands

To grasp the Dutch job market, you need to start with the core numbers. The average gross monthly salary in the Netherlands is around €3,666. However, another crucial figure is the median gross annual salary since it offers a different perspective.

The median income, which represents the middle point where half the population earns more and half earns less, is set at €46,500 per year for 2025. This breaks down to a gross monthly median income of €3,875. The median is often considered a more accurate reflection of typical earnings, as it is not skewed by exceptionally high salaries at the top.

Understanding the difference between your gross (bruto) and net (netto) salary is fundamental. Your gross salary is the total amount before any deductions. Your net income is what finally lands in your bank account after the tax authorities have taken their share. The Dutch tax system for 2025 operates on three progressive brackets:

- 35.82% on income up to €38,441

- 37.48% on income between €38,441 and €76,817

- 49.50% on income above €76,817

As an example, a gross monthly salary of €2,500 might translate to a net take-home pay of around €2,200. Note that this can vary based on your specific situation and eligibility for various tax credits. It is always wise to use an online Dutch salary calculator to get a personalised estimate.

Salary levels by profession and industry

Your chosen career path is one of the most significant determinants of your earning potential. The Dutch economy has strengths in technology, finance, logistics, and agriculture, and the average salary by profession reflects this diverse industrial landscape.

Furthermore, sectors like mining, financial services, and information technology consistently offer above-average monthly incomes. Meanwhile, hospitality, culture, and retail tend to be lower.

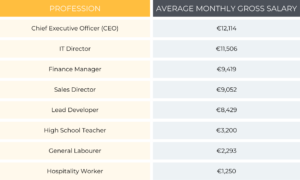

The following table provides a snapshot of how monthly gross earnings can vary across different roles, illustrating the wide range of income levels in the country:

Experience also dramatically shapes this pay scale. The jump from an entry-level position to a senior role can nearly double your compensation. That’s particularly true in high-demand sectors like tech and engineering.

For instance, an entry-level software engineer might start on around €58,000 annually, while a senior engineer with over eight years of experience can command €100,000 or more.

Education also plays a powerful role, since graduates from research universities in subjects like engineering or computer science often command higher starting salaries.

Regional salary differences across the Netherlands

Several key factors influence salary levels across the Netherlands, with the most significant being geographic location. Economic hubs, particularly in the Randstad region, consistently offer higher wages to match the concentration of multinational companies and a higher cost of living.

The following breakdown highlights the regional salary differences you can expect:

- The Randstad region: The Randstad, encompassing Amsterdam, Utrecht, Rotterdam, and The Hague, is the country’s economic heartland. Professionals here typically earn 10-15% more than the national average. That’s due to the high density of multinational corporations and an elevated cost of living. This region consistently reports the highest average salaries, making it the top-paying area in the Netherlands

- Amsterdam: As the premier financial and technological hub, Amsterdam offers the most competitive salaries in the Netherlands. For example, a software engineer in Amsterdam reports an average compensation of around €94,000 per year, compared to roughly €77,000 for a similar role in Groningen. This significant premium reflects intense competition for talent and the city’s high living costs.

- Utrecht: Utrecht, a central transport and business hub, also features salary levels that sit above the national average. Alongside Amsterdam, The Hague, and Rotterdam, it is part of the high-paying Randstad region where wages are pushed up by the concentration of major businesses and the associated cost of living pressures.

- Eindhoven (Brainport): Eindhoven, known as the “Brainport” of Europe, is a standout technology and engineering hub. Driven by companies like ASML and Philips, there is strong demand for engineers and technical specialists. Note that salaries in this region also exceed the Dutch average. It represents a high-paying area outside the traditional Randstad zone.

- Other cities & rural provinces: Cities outside the main economic hubs and rural provinces like Friesland and Groningen generally offer lower wages. However, this is often balanced by a more affordable cost of living, particularly for housing. Also, towns like Loosdrecht and Well have high average incomes, though this can reflect different community demographics rather than broad regional trends.

Cost of living compared to salaries

A high salary only tells half the story. The true measure of its value is how far it goes in covering your monthly expenses. The cost of living, especially housing, varies dramatically across the country.

For example, securing a rental property in Amsterdam or Utrecht will consume a much larger portion of your net income than renting a similar property in a northern city. Such as Groningen or a southern city like Maastricht.

In 2025, private sector landlords are permitted to increase rents by a maximum of 4.1%. This adds pressure to household budgets. Beyond housing, other living costs are also on the rise. The energy tax on natural gas is decreasing slightly, but water rates are increasing sharply by around 11%.

Furthermore, public transport costs are also set to rise, with NS train tickets increasing by an average of 6.18%. For those driving, taxes on electric cars are being phased in, and traffic fines have become more expensive.

Overall, it means that a competitive salary in a major city is often a necessity rather than a luxury. The high average income in the Netherlands is a direct response to these elevated costs. For a comfortable life in a city like Amsterdam, a higher gross salary is required to achieve a similar standard of living to someone earning a moderately lower salary in a more affordable region.

Minimum wage and worker rights in the Netherlands

The Netherlands has a robust social safety net, and its legal minimum wage is a cornerstone of this system. As of July 1st 2025, the gross hourly minimum wage for workers aged 21 and over is €14.40.

This rate is adjusted twice a year, in January and July to account for inflation. For younger workers, a graduated scale applies, with 15-year-olds entitled to a minimum of €4.32 per hour.

Dutch employment law also provides workers with several key employee benefits that add significant value to the total compensation package:

- Holiday allowance (Vakantiegeld): You are legally entitled to at least 8% of your gross annual salary as holiday pay, usually paid as a lump sum in May or June.

- The 13th month: While not mandatory, some companies offer an extra month’s salary, often paid in December. It acts as a substantial annual bonus.

- Sick leave: Dutch law provides strong protection for ill employees. Your employer is required to continue paying at least 70% of your salary for up to 104 weeks (two years) of illness.

- Collective Labour Agreements (CAO): Many sectors are governed by a CAO, which is a collective agreement between unions and employers that sets minimum standards. That’s for pay, benefits, and working conditions for that industry.

Salary trends and forecast for 2025

The Dutch labour market remains tight, with unemployment projected to be a low 3.9% in 2025. This competition for talent, coupled with recent high inflation, has led to strong wage growth. In 2024, nominal wage growth reached 6.4%, and it is forecast to remain elevated at 5.1% in 2025 before easing to 3.7% in 2026.

However, this growth is not uniform across all sectors. There is particularly intense demand for professionals with specialised skills. Roles in software engineering, data science, artificial intelligence, and cybersecurity continue to command premium salaries.

Companies are responding to this competitive landscape not only with higher base pay but also with creative compensation structures. That includes performance bonuses, professional development opportunities, and enhanced benefits.

Hybrid work

Another significant trend is the normalisation of remote and hybrid work. This shift allows employers to tap into talent pools across the country. It can also influence salary differentials based on an employee’s location.

For international hires, the 30% ruling—a tax advantage for qualified expatriates—remains a powerful tool for employers to attract global talent. That’s because it allows a significant portion of the salary to be paid tax-free.

Final thoughts

For professionals and companies alike, a clear and current understanding of the average salary in the Netherlands is not just data. It’s a critical tool for success. For professionals, it empowers confident negotiation and ensures their compensation reflects their true market value.

For businesses seeking to hire, it is the foundation for building competitive & attractive offers that control costs while securing the best talent in a dynamic market.

Navigating the complexities of Dutch employment law, taxes, and compliant contracts can be a significant hurdle. This is where an Employer of Record (EOR) service becomes an invaluable partner. Global companies can use our services for a compliant pathway to hire in the Netherlands without establishing a local entity, while we handle local payroll management, tax compliance, and employment contracts on their behalf.

Meanwhile, professionals can use our services for a more secure onboarding experience with a legally sound employment contract. Ready to simplify your Dutch hiring or ensure your employment terms are optimal?

Contact us to speak with one of our local experts

Frequently asked questions

What is a good salary in the Netherlands in 2025?

A good salary depends on your lifestyle and location. A single person in a city like Amsterdam might need a gross annual income of €50,000-€60,000 for a comfortable life, including rent.

Outside major hubs, €40,000 could be sufficient. Additionally, the median gross annual salary provides a solid benchmark for a middle-class income.

How much tax will I pay on my Dutch salary?

The Netherlands uses a progressive tax system with three brackets in 2025. You pay 35.82% on income up to €38,441, 37.48% on earnings up to €76,817, and 49.50% on anything above that.

Your effective tax rate is a blend of these brackets, so not all your income is taxed at the highest rate.

What is the difference between gross and net salary?

Your gross salary (bruto salaris) is your total income before any deductions. Your net salary (netto salaris) is your take-home pay after deducting income tax, social security contributions, and pension premiums.

The difference between the two can be significant, so always clarify which figure is being discussed.

Is the average salary in the Netherlands enough to live on?

Yes, the average and median salaries are generally sufficient to maintain a good standard of living. However, in major cities with high housing costs, budgeting carefully is essential. The high minimum wage and strong social security system also provide a solid foundation for lower-income households.