UK digital nomad visa explained: options for remote workers and freelancers

The rise of digital nomadism has changed the way people live and work across the globe. With more professionals seeking flexible lifestyles, a common question arises: “Can I work remotely as a freelancer from the UK?”

The UK, known for its dynamic cities, rich culture, and strong international connections, is an attractive destination for remote workers. However, understanding the legal routes available is crucial. Unlike some European countries that offer specific digital nomad visas, the UK’s system is more complex — but that doesn’t mean relocating or working with UK clients is impossible.

In this guide, you’ll learn about the current visa landscape, alternative options for freelancers, key tax considerations, and how Hightekers can support you in managing this process legally and with confidence.

Does the UK have a digital nomad visa?

To put it simply: no, the UK does not currently offer a specific digital nomad visa.

While countries like Portugal, Spain, and Estonia have introduced targeted visas for remote workers, the UK has not created a similar programme. This sometimes causes confusion, as freelancers and digital nomads often assume that a standard tourist or visitor visa may allow them to work remotely in the UK – but this is not the case.

Still, depending on your situation, there are alternative legal pathways that could allow you to live or work in the UK, provided you meet specific requirements. Choosing the right path ensures you stay compliant and avoid legal or tax issues later on.

Legal visa options for freelancers wanting to stay in the UK

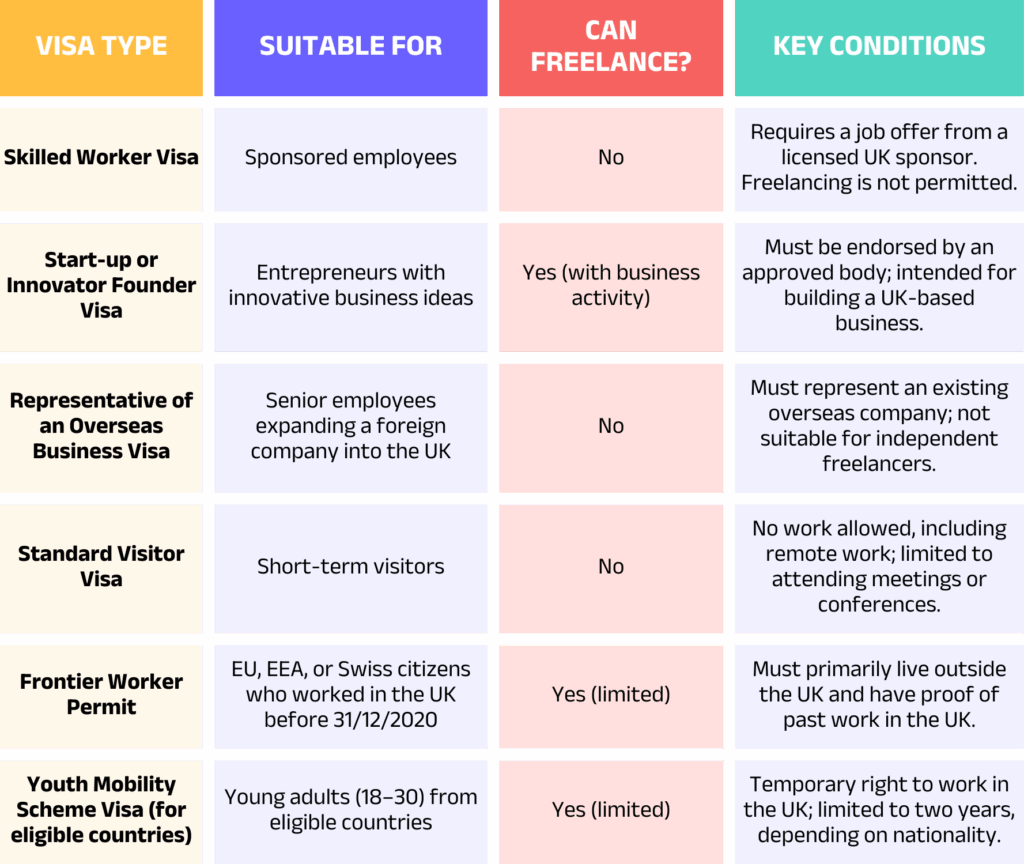

Although there’s no dedicated digital nomad visa UK, several visa categories may be suitable for freelancers or entrepreneurs. It’s important to note that these options often come with strict conditions, and professional legal advice should be sought for complex cases. Here’s an overview:

1. Skilled worker visa: This visa requires sponsorship from a UK-registered employer. Freelancers cannot sponsor themselves, so this option is generally suitable only if you have an offer of employment with an eligible company.

2. Start-up or innovator founder visas: If you have an innovative business idea and the support of an approved endorsing body, you may apply under these schemes. It’s a good fit for entrepreneurs planning to launch a UK-based business, though it is not intended for traditional freelancing or remote client work.

3. Representative of an overseas business visa: If you’re setting up a UK branch for an overseas company, this visa may apply. It’s suited to senior employees, not independent freelancers.

4. Standard visitor visa: This short-term visa allows you to visit the UK for up to six months. Working while in the UK on a visitor visa is strictly prohibited, including remote work for a foreign company. You can attend meetings, conferences, or events, but any paid work, even remote work for non-UK clients, risks breaching your visa conditions.

5. Frontier worker permit: For EU, EEA, or Swiss citizens who worked in the UK before 31/12/2020 but live primarily abroad, this permit allows continued work in the UK without residency. It’s a narrow and specialised option.

6. Other long-stay visas: Depending on your nationality, family connections, or academic plans, you may qualify for visas such as the Global Talent visa, Youth Mobility Scheme (for eligible countries and age groups), or Family Visas.

Each route has its own set of rules regarding self-employment, tax obligations, and duration of stay. Therefore, understanding your options early is crucial before planning a move.

To help you understand your options more clearly, here’s a quick overview of visa types available for those considering remote work or freelancing connected to the UK.

As you can see, each visa option comes with specific conditions and restrictions. It’s important to choose the route that best matches your professional goals — and where needed, seek expert advice to ensure full legal compliance.

What about working with UK clients while living abroad?

For many freelancers, relocating isn’t necessary – they simply want to work with UK clients while living elsewhere.

The good news is that you can freelance for UK clients while living abroad, provided you maintain the correct legal and tax status in your country of residence.

However, several important factors should be kept in mind:

- Your income may still be subject to tax in your home country.

- You may need to consider VAT registration rules if billing UK clients.

- Your clients in the UK may face obligations around contracts, tax withholding, or compliance if you’re not properly registered.

International tax treaties (known as Double Taxation Agreements) often help prevent the same income being taxed twice, but freelancers must be careful to manage residency and tax filing properly.

In short, while freelancing for UK clients is fully possible from abroad, compliance is key — both for you and your clients.

Tax and legal considerations for remote workers

Whether you relocate or work with UK clients remotely, tax and legal compliance should not be overlooked. Some key points to understand include:

- Tax residency: If you spend more than 183 days in the UK in a tax year, you may become a UK tax resident. This triggers full tax obligations on your worldwide income, not just UK earnings.

- Social security and healthcare: Freelancers relocating to the UK must usually pay National Insurance contributions (social security). Access to the NHS (public healthcare) is linked to residency and these contributions.

- Correct invoicing and multi-currency management: Freelancers working internationally must invoice properly, using clear terms and complying with UK accounting standards where necessary. Working across different currencies (GBP, EUR, USD) also requires careful financial management to avoid errors in tax returns.

- GDPR compliance: If you handle data from UK clients or customers, you must comply with UK GDPR standards, which regulate how personal data is collected and processed.

Ignoring these responsibilities can result in fines, legal issues, or problems with future visa applications – which is why many freelancers choose professional support.

How Hightekers simplifies international freelancing with UK clients

Understanding tax, legal, and visa requirements is one thing — managing them daily while trying to grow your freelance business is another challenge entirely.

This is where Hightekers offers a powerful solution for international freelancers.

Instead of setting up a UK company, registering for taxes, or learning complex visa systems, Hightekers allows you to work with UK clients through a fully compliant structure:

- Hightekers acts as your legal employer, providing you with a UK contract and managing all the necessary administrative, legal, and financial responsibilities.

- You work with your own clients while Hightekers handles your invoicing, tax contributions, social charges, and regulatory compliance.

- You avoid the need for costly and time-consuming local registrations or complex company setups.

- Hightekers also assigns you a dedicated account manager, providing personal support, answering legal or financial questions, and helping you run your freelance activity smoothly.

This model enables freelancers to focus on their work while remaining fully compliant with UK and international regulations: whether working from abroad or eventually relocating to the UK.

By partnering with Hightekers, freelancers enjoy the freedom of global work, backed by a reliable legal and financial foundation.

Final thoughts

Although the UK doesn’t offer a dedicated digital nomad visa, it remains a highly attractive market for remote workers and freelancers. Whether you plan to live in the UK or simply work with UK clients from abroad, understanding your visa options, tax obligations, and compliance responsibilities is essential.

Rather than managing the complexities alone, partnering with experts can save time, money, and stress.

Hightekers offers a smart, compliant pathway for international freelancers who want to tap into the UK market while keeping their professional freedom.

Simplify your international freelance activity with Hightekers.

Contact us today to learn more!