Freelance Taxes in 2026: A Global Guide for Remote Professionals

For the modern remote professional, the world is both a workplace and a playground. Yet with this unprecedented freedom comes a web of tax obligations that can seem dauntingly complex. Understanding your self-employed tax obligations helps to maximise your financial potential across borders.

This guide illuminates the path through the evolving landscape of international freelance taxes. Hence, you’ll achieve the confidence to work from anywhere while staying firmly on the right side of tax authorities.

Key takeaways

- Our tax residency status generally determines where you pay taxes rather than citizenship.

- Freelance taxes differ significantly from employment taxes with requirements to manage your own deductions.

- Understanding double taxation treaties can prevent being taxed twice on the same income.

- Multiple countries are implementing digital reporting requirements like the UK’s Making Tax Digital.

- Strategic use of allowable business expense deductions can significantly reduce taxable income.

- Maintaining meticulous financial records is essential for freelance income reporting compliance.

Understanding freelance taxes

When you work as an employee, your employer typically withholds income taxes, social security contributions, and other statutory deductions before your salary ever reaches your bank account. As a freelancer, you receive gross payments and must set aside funds to cover your future tax obligations.

Additionally, while employees usually have a single primary source of income tied to one location, freelancers often have multiple income streams from clients in different countries, creating a more complex tax profile.

Core tax concepts for international freelancers

Understanding several key concepts is essential for navigating international freelance taxes. Your tax residency status generally dictates where you pay taxes on your worldwide income.

Most countries use a 183-day threshold as a primary determinant, though some employ more complex tests like the UK’s Statutory Residence Test. The concept of domicile may also affect your tax treatment in some jurisdictions.

Key filing requirements and deadlines

Freelancers must be particularly mindful of tax deadlines, which vary between countries. For instance, in the UK, the tax year runs from 6th April to 5th April, with online self-assessment returns due by 31st January following the end of the tax year.

Missing these deadlines can result in substantial penalties, making calendar management an essential freelancing skill.

Tax obligations by region

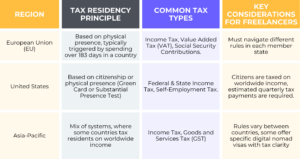

Dealing with international tax systems represents one of the most challenging aspects of freelancing across borders. While each country maintains its own rules and rates, understanding regional patterns can provide a framework for compliance.

European Union variations

The EU presents a complex landscape for freelancers, with each member state maintaining distinct tax systems while adhering to certain common frameworks. Most EU countries determine tax liability based on residency, typically triggered by spending more than 183 days in the country.

Furthermore, many European countries participate in social security coordination regulations that can determine which country’s social security system you contribute to as a freelancer.

United States

The Internal Revenue Service (IRS) governs freelance taxation in the U.S. Key obligations include:

- Filing requirement: You must file a tax return if your net earnings from self-employment are $400 or more in a year.

- Self-employment tax: This is a separate 15.3% tax that covers your contributions to Social Security (12.4%) and Medicare (2.9%). There is an income threshold for the Social Security portion, but the Medicare tax applies to all earnings.

- Quarterly estimated taxes: Freelancers generally need to pay estimated taxes quarterly using Form 1040-ES if they expect to owe $1,000 or more in tax for the year. This covers both income tax and self-employment tax.

- Annual filing: Report your business income and expenses on Schedule C, which is filed with your personal Form 1040. Calculate your self-employment tax on Schedule SE.

Asia-Pacific region

The Asia-Pacific region displays remarkable diversity in its approach to freelance taxation. Some countries like Singapore offer relatively straightforward tax systems with progressive rates and territorial taxation principles, while others have more complex structures.

Furthermore, many countries in the region have introduced specific digital nomad visas with clear tax guidelines, while others maintain more ambiguous positions on remote work taxation for foreign employers.

Tax system regional comparison

Tax deductions and credits for freelancers

Common allowable deductions

Taxes for digital nomads in most jurisdictions permit the deduction of ordinary and necessary business expenses. In the UK, HMRC allows deductions for costs incurred “wholly and exclusively” for business purposes. Common categories include:

- Office supplies and equipment: This includes computers, software, stationery, and other tools directly used in your freelance work. You may be able to claim the full cost of equipment in the year of purchase or spread it over several years through capital allowances.

- Professional development: Training courses, certifications, and books directly related to maintaining or improving your current professional skills are typically deductible. However, costs related to training for a completely new profession are often disallowed.

- Business-related travel: Travel expenses for client meetings, conferences, or business development are generally deductible, though ordinary commuting between your home and a regular workplace is not. This includes train fares, flight tickets, hotel accommodations, and reasonable meal expenses during business travel.

- Marketing and professional services: Costs for website development, advertising, business cards, and professional memberships are typically allowable.

- Home office expenses: If you work from home, you can claim a proportion of your household running costs based on the space used exclusively for business and the time it’s used for that purpose.

Documentation requirements

Proper documentation is essential for substantiating your deductions in case of review or audit by tax authorities. Therefore, maintain organised records including receipts, invoices, bank statements, and mileage logs.

For each expense, record the date, amount, vendor, and business purpose. Digital tools can significantly streamline this process. That’s through photo capture, automatic categorisation, and cloud storage.

Tax credits vs. deductions

While deductions reduce your taxable income, tax credits directly reduce your tax liability. Many countries offer various tax credits for specific activities like research and development, hiring employees from certain groups, or implementing environmentally friendly business practices.

Though less common for individual freelancers, exploring available tax credits in your country of residence can yield additional savings.

Paying taxes as a remote professional internationally

Mastering international tax compliance separates professionally managed freelance practices from amateur operations. The complexity of reporting income from multiple countries, navigating currency fluctuations, and understanding varying deduction rules requires strategic planning.

Double taxation treaties in practice

Double taxation treaties form the foundation of international tax compliance for freelancers working across borders. These bilateral agreements between countries determine which nation has the primary right to tax specific types of income.

Most treaties follow similar principles based on model conventions developed by the OECD. The fundamental premise is that while countries maintain the right to tax their residents on worldwide income. Also, they cede certain taxing rights to other countries for income sourced within their territories.

For freelancers, this typically means that the country where you’re physically present when performing the work has the primary right to tax that income. That’s regardless of where your client is based or your business is registered.

Understanding digital payment reporting

The rise of digital payment platforms has created both convenience and complexity for international freelancers. While services like PayPal, Wise, and various digital banks have simplified receiving payments from international clients, they’ve also attracted increased scrutiny from tax authorities.

Many countries now require payment processors to report transaction data, and tax authorities are increasingly sophisticated at matching this information to tax returns.

Therefore, freelancers should maintain meticulous records of all payments received, regardless of the platform used. Be particularly mindful of potential tax reporting requirements for cryptocurrency payments. That’s because many jurisdictions have introduced specific reporting rules for digital assets.

Avoiding common penalty triggers

International tax compliance mistakes can lead to significant penalties, but most are avoidable with proper planning. Common triggers include:

- Underpayment of estimated taxes: Many countries require freelancers to make advance tax payments throughout the year. The United States imposes quarterly estimated tax payments, while the UK uses a “payments on account” system for those with tax bills over £1,000. Underestimating these payments can result in penalties.

- Late filing: Missing tax return deadlines almost universally trigger automatic penalties that increase over time. These are easily avoided through proper diary management and early preparation.

- Failure to report foreign accounts: Many countries, including the United States, require citizens and residents to report foreign financial accounts exceeding certain thresholds. The US FBAR requirement applies to accounts aggregating over $10,000 at any point during the year.

- Inaccurate transfer pricing: For freelancers working with related entities in different countries, ensuring that cross-border charges are reasonable is essential to avoid penalties.

Strategic tax planning

Beyond mere compliance, strategic international tax planning can help optimise your overall tax position while maintaining full legality. This might involve:

- Carefully timing international movements to avoid creating tax residency in high-tax jurisdictions.

- Structuring your business through appropriate entities in favourable jurisdictions.

- Maximising contributions to tax-advantaged retirement plans.

- Leveraging all available foreign tax credits to avoid double taxation.

- Planning the timing of income and deductions to smooth out tax liabilities.

Tools and strategies for efficient tax management

Digital record-keeping solutions

Comprehensive digital record-keeping forms the foundation of efficient tax management for contemporary freelancers. Modern applications allow you to:

- Capture receipts instantly via smartphone cameras

- Automatically categorise expenses through machine learning

- Generate real-time reports on your profit and loss

Furthermore, cloud-based accounting platforms like QuickBooks, Xero, and FreeAgent offer features specifically designed for freelancers and sole traders. These systems can connect directly to business bank accounts and credit cards, automatically importing and categorising transactions.

Quarterly tax planning framework

For freelancers, managing cash flow to meet tax obligations requires a disciplined approach to setting aside funds. Implement what’s sometimes called the “envelope system” for taxes: maintaining a separate bank account specifically for future tax payments.

Each time you receive client payment, immediately transfer a percentage—typically 25-35% depending on your marginal tax rate—to this designated tax account. This practice ensures funds are available when tax payments come due.

The most effective freelancers implement a quarterly review process, examining their year-to-date income and expenses to refine their tax estimates.

How Hightekers can help

For freelancers navigating the labyrinth of global tax codes, a specialised service like Hightekers provides indispensable clarity. We’ll streamline the entire process by offering expert guidance on international freelance taxes, helping you determine tax residency, leverage double taxation treaties, and identify all eligible tax deductions for freelancers.

Our support ensures accurate freelance income reporting and timely submissions across different jurisdictions, minimising the risk of errors and penalties. By handling the complex paperwork and strategic planning, Hightekers allows you to redirect energy from administrative burdens to your actual work.

Ready to get started?

See how Hightekers helps freelancers stay compliant across borders

Frequently asked questions

How do I determine my tax residency as a digital nomad?

Your tax residency is typically determined by where you maintain permanent ties or spend the most time. Most countries consider you a tax resident if you spend 183 days or more there in a tax year.

As a digital nomad, you might not be tax resident anywhere if you move frequently, but you still owe tax on income sourced from each country where you work.

How can I avoid double taxation on my freelance income?

Double taxation treaties between countries prevent being taxed twice on the same income. These agreements typically allow you to claim foreign tax credits in your country of residence for taxes paid to source countries, or provide exemptions for foreign-earned income.

As a freelancer, you’d generally declare worldwide income in your resident country but claim relief for taxes paid elsewhere. Proper documentation of foreign taxes paid is essential.

What are the tax implications if I work remotely for a foreign company?

When working remotely for a foreign company, your physical location typically determines where you pay taxes. It’s not your employer’s location. For example, if you’re a tax resident in the UK but work for an Australian company, you’d pay UK tax on that income.