Understanding the UK Tax Code: A Complete Guide

Understanding your UK tax code is both crucial and notoriously tricky. For employees, a single misstep can mean unexpected bills or missing out on hard-earned cash. For expats who recently moved, the system can feel like a labyrinth of unfamiliar rules. And for companies hiring talent in the UK, getting it wrong risks payroll errors and employee dissatisfaction.

These seemingly random numbers and letters directly control your income, making comprehension essential. This guide exists to demystify the entire process, transforming confusion into clarity.

We will break down the logic behind the codes, empowering each of these groups with the knowledge to manage their finances. We’ll also share how our Employer of Record service will help you manage all tax-related matters when expanding to the United Kingdom.

What is a UK tax code?

A tax code is a combination of letters and numbers used by your employer or pension provider to determine the correct amount of Income Tax to deduct from your pay. That’s under the Pay As You Earn (PAYE) system. It is issued by HM Revenue and Customs (HMRC) and is fundamental to ensuring you pay the right tax across the tax year. It runs from 6th April to 5th April the following year.

Your tax code essentially communicates two things: your tax-free Personal Allowance (the amount you can earn each year without paying any tax) and how that allowance should be applied based on your personal circumstances.

An incorrect code could lead to an unwelcome tax bill or mean you are overpaying, making it crucial to check yours regularly. You can find your current tax code on your payslip, in the HMRC app, or on a ‘Tax Code Notice’ letter from HMRC

How to read your tax code

Breaking down your tax code into its components makes it much less intimidating. The structure is logical and, once understood, tells you a clear story about your tax situation.

The numbers

The numbers in your tax code represent your tax-free Personal Allowance. To find out what this amount is, you simply multiply the number by 10. For instance, the most common tax code for the 2024/25 tax year is 1257L. The ‘1257’ part means the individual has a Personal Allowance of £12,570 (£1,257 x 10).

This is the standard Personal Allowance for most people. However, this number can be higher or lower if you have other factors that affect your allowance. For example, taxable benefits from your job, like a company car.

The letters

The letter in your tax code reveals your specific situation and how it influences your UK taxes. It provides context for the numbers. Here are some of the most frequent letters you will encounter:

- L: Entitles you to the standard tax-free Personal Allowance. This is the most common letter.

- M: You have received a transfer of 10% of your partner’s Personal Allowance through the Marriage Allowance.

- N: You have transferred 10% of your Personal Allowance to your partner through the Marriage Allowance.

- T: This means other calculations are needed to work out your Personal Allowance, often used when your situation is more complex.

- BR: This means all income from this job or pension is taxed at the basic rate of 20%. It is commonly used for a second job or pension where your Personal Allowance is applied to your main income.

- D0: All income from this job or pension is taxed at the higher rate of 40%. This is also typical for a second income source.

- K: This code is used when the income you haven’t paid tax on (such as company benefits or owed tax from a previous year) is higher than your Personal Allowance.

Regional variations

The UK has different income tax bands for Scotland and Wales, which are reflected in their tax codes.

- S (Scotland): Your income is taxed using Scottish rates and bands. For example, S1257L is the Scottish equivalent of 1257L.

- C (Cymru): Your income is taxed using Welsh rates and bands. For example, C1257L is the Welsh equivalent.

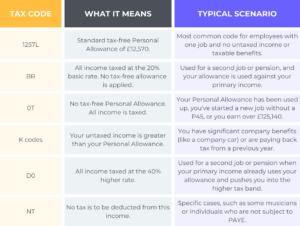

Common tax codes and what they mean

While there are many permutations, a handful of different tax codes in UK payroll systems cover the majority of full-time employees. Understanding this list of tax codes UK-wide will help you quickly identify your own.

Emergency tax codes

Sometimes, HMRC doesn’t have enough information to assign a correct tax code. This often happens when you start a new job without a P45, enter employment after being self-employed, or start receiving a company pension. In these cases, you might be put on an emergency code. These are temporary and mean you might pay tax on all your income above the basic Personal Allowance.

You can identify an emergency tax code if it has ‘W1’, ‘M1’, or ‘X’ at the end (for example, 1257L W1). These are non-cumulative codes, meaning your tax is calculated solely on what you earn in that specific pay period, without considering how much tax you have already paid in the year. This can sometimes lead to temporary overpayment, which HMRC will usually rectify automatically once you provide the necessary details.

How HMRC assigns and updates tax codes

HMRC is responsible for calculating and issuing your tax code. The process typically begins when you start a new job. Your employer will use the details from your P45 form from your previous job to apply the correct code. If you don’t have a P45, you will need to complete a Starter Checklist for your new employer. They will then use this information to determine the right code, which may initially be an emergency code.

Your tax code is not set in stone. HMRC will update it when your circumstances change. Common reasons for a change include:

- Starting or stopping a second job or receiving a new source of income.

- Starting or stopping receiving taxable job benefits, such as a company car or private medical insurance.

- Claiming or cancelling the Marriage Allowance.

- Receiving taxable state benefits.

- Having underpaid or overpaid tax in a previous year, which HMRC decides to collect or refund through your future tax deductions.

When your tax code changes, HMRC will normally notify you directly with a coding notice.

That’s either by post or via your personal tax account, and will also inform your employer. Note that it’s your employer’s responsibility to update your record in their payroll software.

How to correct or challenge your tax code

HMRC’s systems are generally reliable, but mistakes can happen. If you believe your tax code is wrong, it is important to act quickly to avoid ongoing over or underpayment.

Here is the step-by-step process:

- Check your personal tax account: The first and best step is to sign in to your personal tax account on the GOV.UK website or use the HMRC app. This portal provides a detailed breakdown of how HMRC calculated your tax code, including the income and benefits they have on record for you.

- Gather your documents: Before contacting HMRC, have your most recent payslips, P45, P60, and details of any benefits or expenses handy. This will help you pinpoint any discrepancies.

- Contact HMRC directly: If you identify an error, you need to inform HMRC. You can do this by phone or through your personal tax account. Be ready to explain clearly why you think the code is incorrect—for example, “I believe my code is wrong because it includes a company car benefit that I no longer receive.”

- Provide correct information: If your code is wrong because your circumstances have changed and HMRC doesn’t know, you can update your details online or by phone. This includes changes of address, changes in income, or stopping a taxable benefit.

- Understand the appeal process: If you disagree with HMRC’s decision after contacting them, you have the right to appeal. The coding notice or the letters from HMRC will explain how to do this formally. You can also ask for a review by a different HMRC officer.

Staying proactive with your tax affairs is the most effective way to ensure your code remains correct. Informing HMRC promptly of any changes in your income or benefits will prevent problems down the line.

How an Employer of Record can help

An Employer of Record is a compliance and payroll support solution for companies hiring in the UK. That’s especially true for international employers without a local entity or teams managing cross-border remote workers.

An EOR helps:

- Ensure employees hired in the UK are set up correctly with HMRC.

- Manage PAYE payroll, tax code updates, and statutory deductions.

- Handle communication with HMRC when tax codes need to be corrected or adjusted.

- Prevent compliance mistakes when hiring expats or workers who move to/from the UK.

- Allow foreign companies to legally hire in the UK without creating a local subsidiary.

For both employees and employers navigating the complexities of UK employment, Hightekers offers a streamlined solution through its Employer of Record (EOR) services. We assume all legal responsibility for your workforce, ensuring full compliance with local tax laws and employment regulations.

Contact Hightekers to achieve UK tax compliance

Frequently asked questions

What should I do if I have a BR tax code for my main job?

If your main job has a BR code, you are likely not receiving your tax-free Personal Allowance and are being overtaxed. Contact HMRC to inform them which employment should be your primary one so they can apply your Personal Allowance correctly and issue a new code.

Why has my tax code changed when I started a new job?

Changing jobs often triggers a tax code update because HMRC receives new information. If you did not provide a P45, you may be placed on an emergency code temporarily. Furthermore, your code will be updated once your details are fully processed.

How does having multiple jobs affect my tax code?

Your Personal Allowance is typically applied to one job, which is usually your main employment. Your second or subsequent jobs will often be taxed at a flat rate using a BR (basic rate), D0 (higher rate), or D1 (additional rate) code. This ensures the correct total tax is collected across all incomes.

What does a K tax code mean?

A K code means your taxable company benefits or other untaxed income exceed your Personal Allowance. The number in the K code (multiplied by 10) is added to your taxable income. Also, the law limits the tax deducted to no more than half your pre-tax pay in any period.

Where can I find my tax code?

You can find your tax code on your payslip, your P45 or P60 forms, by signing into your personal tax account on the GOV.UK website, or through the official HMRC app.