What Is IR35 UK and Why It Matters for Contractors

For contractors and businesses engaging flexible talent in the UK, a firm grasp of the IR35 legislation is required for operational and financial security. For contractors, a misunderstanding can lead to devastating, retrospective tax bills from HMRC, threatening their livelihood.

For businesses, failure to correctly determine a worker’s status can result in significant liability for unpaid taxes, penalties, and reputational damage. Ultimately, navigating IR35 successfully is what enables a compliant and sustainable working relationship when expanding to the UK.

What is IR35?

If you’re a contractor in the UK, understanding what is IR35 UK legislation is non-negotiable. At its heart, IR35 is a set of tax rules designed to identify and stop what HMRC calls ‘disguised employment’.

But what does that mean in practice? Imagine a scenario where an individual works in a role that is functionally identical to a permanent employee, but they provide their services through their own limited company, known as a Personal Service Company(PSC). By working through a PSC, the individual can potentially draw income in a tax-efficient way.

This means paying themselves through a combination of a small salary and dividends, thereby reducing their overall Income Tax and National Insurance Contributions (NICs) liability.

The IR35 rules exist to ensure that if a worker would have been an employee, they pay broadly the same tax and NICs. That’s even when working through their own company. The legislation was first introduced in the year 2000, and its application has evolved significantly, particularly in the last few years.

For any contractor operating through their own limited company, getting to grips with what is IR35 UK framework is the first step towards ensuring full compliance and making informed decisions.

How IR35 affects contractors

The central question for every contractor is whether their engagement is inside or outside IR35. This distinction has profound financial and operational implications.

The financial impact of being inside vs. outside IR35

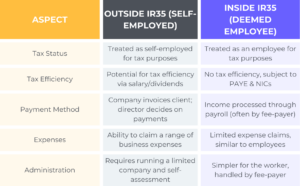

The difference between being inside and outside IR35 is substantial, primarily affecting your take-home pay and how you manage your finances. The table below summarises the key differences:

When you are outside IR35, you are seen as a genuine small business running your own enterprise. You invoice your client through your limited company, and the income to your company is not subject to PAYE at source. You can then pay yourself in a tax-efficient manner, typically through a combination of a low salary and dividends from the company’s post-tax profits.

In contrast, if you are inside IR35, the entire income is subject to full PAYE Income Tax and employee NICs. Critically, the fee-payer (which could be your client, the agency, or your IR35 umbrella company) must also pay the employer’s NICs and the Apprenticeship Levy on top of the contract rate.

This often means that to maintain the same take-home pay, IR35 contractors would need to negotiate a higher day rate to compensate for these additional tax burdens.

Recent changes to

IR35 legislation

The landscape of IR35 has been anything but static. Major reforms have reshaped who holds the responsibility for determining a contractor’s status, and further tweaks are on the horizon.

The shift of responsibility to the end client

The most significant change in recent years was the extension of the off-payroll working rules to the private sector in April 2021. This mirrored the 2017 public sector reform. Before this, contractors working for private sector clients were responsible for determining their own IR35 status. The reform shifted this responsibility from the contractor’s limited company to the medium or large end-client engaging them.

This means that for most engagements with substantial businesses, it is no longer the contractor who decides their status. The end-client must now:

- Perform a ‘reasonable’ assessment of the contractor’s employment status for tax purposes.

- Issue a Status Determination Statement (SDS) that clearly states the decision (inside or outside IR35) and the reasons behind it.

- Have processes in place to handle status disagreements from the contractor.

It is crucial to note that ‘small’ private sector companies are exempt from these rules. Until April 2025, a company was considered ‘small’ if it met two or more of these criteria. A turnover of not more than £10.2 million, a balance sheet total of not more than £5.1 million, and not more than 50 employees.

From April 2025, these thresholds have increased to £15 million turnover and £7.5 million on the balance sheet (employee count remains at 50). For contractors engaged by small clients, the responsibility for determining IR35 status remains with the contractor’s own limited company.

Key updates for 2025 and beyond

- Addressing double taxation: A major fairness update from April 2025 is the introduction of an offset mechanism. Previously, if HMRC disagreed with a client’s ‘outside IR35’ determination, the client could be liable for the full tax bill. That’s even if the contractor had already paid some tax via their limited company. Now, HMRC will account for tax already paid by the contractor, preventing this ‘double taxation’ and reducing financial risk for non-compliant clients.

- New umbrella company regulations: The government is cracking down on non-compliance in the umbrella company market. From 6 April 2026, new rules will make end clients, agencies, and umbrella companies jointly and severally liable for correct PAYE and NICs compliance. This means if an umbrella company fails to operate PAYE correctly, HMRC can pursue the agency or even the end client for the unpaid tax.

How contractors can prepare for IR35

Proactivity is your greatest defence against IR35 complications. Instead of fearing the rules, a prepared contractor uses them as a framework to build a robust, compliant business.

How to check IR35 status accurately

Knowing how to check IR35 status is a critical skill. The starting point for many is HMRC’s own Check Employment Status for Tax (CEST) tool. It is free to use and HMRC states it will stand by the results provided the information given is accurate and in line with their guidance.

However, it is vital to know that the CEST tool has been heavily criticised. It has been known to produce an ‘undetermined’ result in a significant number of cases, and critics argue it places too much weight on substitution while not adequately considering Mutuality of Obligation.

Therefore, while CEST can be a useful initial indicator, it should not be your only assessment. For a definitive view, especially for high-value contracts, consider:

- Seeking a professional review: Many specialist accounting and legal firms offer contract review services. They will examine both your written contract and your actual working practices to provide a robust, expert opinion on your status.

- Using a comprehensive IR35 contract checklist: Arm yourself with a detailed checklist to review your own position.

Your IR35 contract checklist

Using a reliable IR35 contract checklist can help you assess your position before seeking professional advice. Here are key points to examine:

- Control: Does the contract state that you are in charge of how, when, and where you complete the work? Are you managed by outputs and results rather than set working hours?

- Substitution: Determine if your contract includes a genuine and unfettered right to send a substitute to do the work. This must be a real right and not just a paper clause.

- Mutuality of obligation: figure out if there is a clear end-point to the engagement, such as project completion. Does the contract avoid any obligation for the client to offer future work or for you to accept it?

- Equipment and expenses: Consider the use of your own equipment. Then evaluate if you bear your own costs and risks, such as rectifying mistakes at your own expense.

- Financial risk: Do you have professional indemnity insurance? It’s important to consider if you paid on a project basis with the risk of not getting paid when the project is not delivered. That’s opposed to an hourly or daily rate for time spent.

- Integration: Are you presented as an external supplier to the client’s staff? Then evaluate your participation in employee benefits, appraisals, or internal meetings not relevant to your project.

Best practices for ongoing compliance

Ensure contract and reality align

The biggest cause of IR35 disputes is a difference between the written contract and the actual working practices. You could have a perfectly drafted ‘outside IR35’ contract, but if you are treated like an employee day-to-day, HMRC will use the reality to determine your status.

Maintain clear documentation

Keep detailed records of your projects, communication with clients (showing you are directing the work), and evidence of your business operations. A ‘Confirmation of Arrangements’ letter, signed by the client, which summarises the working relationship, can be valuable evidence.

Communicate openly with clients

Discuss IR35 with your agency and end-client. Understand how they made their determination and ensure they understand your working practices. Furthermore, push back against blanket inside or outside IR35 assessments that are not based on a role-by-role review.

Plan for different scenarios

If a role is determined to be inside IR35, calculate your take-home pay through an umbrella company or your own limited company’s payroll to ensure the rate is still viable. Additionally, be prepared to walk away if the assessment is incorrect and the client is unwilling to reconsider.

Why understanding

IR35 matters

For contractors, ignorance of IR35 is a significant financial and legal risk. A misunderstanding or incorrect assessment of the rules can lead to a devastating tax bill from HMRC. That’s complete with interest and potential penalties, sometimes years after the work was completed.

HMRC can investigate engagements going back several years, and the financial liability can be enough to threaten the survival of your business.

However, when you understand IR35, you transform it from a threat into a strategic tool. It empowers you to structure your business and engagements correctly, demonstrating to clients and HMRC that you are a genuine, self-employed business. This knowledge protects your income, provides peace of mind, and allows you to focus on delivering excellent work for your clients.

For contractors and businesses seeking a compliant, flexible solution, partnering with Hightekers is a top choice. We’ll seamlessly manage all tax and legal obligations, payroll calculations, and much more. Hence, you can focus on your work instead of complex regulations.

Get in touch with an expert and stay fully compliabt with IR35

Frequently asked questions

What is the main purpose of the IR35 legislation?

The main purpose of IR35 is to combat tax avoidance. Therefore, it ensures that individuals who work like employees, pay broadly the same Income Tax and National Insurance Contributions as if they were directly employed.

Who is responsible for deciding my IR35 status?

This depends on your client. If your client is a medium or large company in the private sector or a public sector body, they are responsible for determining your status. Furthermore, they must provide you with a Status Determination Statement.

If your client is a ‘small’ private sector company, you remain responsible for determining your own IR35 status.

What should I do if I disagree with a client’s ‘inside IR35’ determination?

The off-payroll rules require your client to have a status disagreement process in place. You should first use this formal process to challenge the decision. In practice, it means providing clear evidence and reasoning based on the contract and working practices as to why you believe the role is outside IR35. The client is obliged to consider your appeal.